DYDX: Teaching an Old Dog New Tricks

Bullish unlock into v4.

Disclaimer: This report was first published exclusively for Ouroboros Lifetime Access Pass holders on 24 Aug ‘23 here.

Over the past month we have accumulated a core position in DYDX at the ~$2 level, believing the transition to v4 will inspire a “bullish unlock”. Our immediate bullish view is premised on 1) a spot bid of DYDX tokens into v4 as potential validators accumulate spot tokens to capture exchange fees accruing to the token post v4 and 2) a surge in product innovation post decentralization in v4. Additionally, over the longer term, we see factors such as - i) the ability for validators to capture MEV, ii) greater adoption through new features such as prediction markets and account abstraction and iii) CEX FUD - driving fee growth.

Introduction

V4 catalyst + New verticals + Volumes have troughed

DYDX v4 is going live sometime in late September. This is an update that will materially change tokenomics and supercharge the already present product market fit of the product.

DYDX launched in 2021, taking the market by storm with its tremendous volume, at one point of time even flipping Coinbase’s. Then, volumes were heavily driven by incentives and there was a fair amount of wash trading involved to capture the incentives. Today, the reality is entirely different and DYDX is the top perp DEX with ~60% market share and wash trading is minimal (with fees frequently outpacing incentives).

As we move to a world where more perps are traded on-chain rather off-chain, we expect DYDX to continue outperform with superior fees, better UX and potentially even becoming a derivative platform complete with options, prediction markets and many more.

What is v4?

In short, v4 features the migration of dYdX to its own chain built with the Cosmos SDK. v4 was first announced in Jan’22 with a follow up announcement in Jun’22 that provided details about the dYdX chain.

Previously, fees were not accrued to the token holders but were instead given to equity holders, essentially making the token a useless governance token. v4 and the dYdX chain will see fees going to stakers which means we can see v4 as the introduction of a fee switch for tokenholders.

Report Structure:

- Investment Thesis

- Mythbusters

- Bonus Catalysts

- Conclusion

Investment Thesis #1: ~20% APR for DYDX stakers post v4.

There are multiple signposts pointing towards 100% fee accrual to the DYDX token post v4.

Based on current DYDX fees ($50mn - trailing 30D fees annualized), we estimate from Day 1, validators’ staking yield would start minimally at 15% (assuming all circulating DYDX are staked) but is likely to be closer to 20% (assuming % of tokens staked to be similar to other highly fee accretive tokens such as SNX, GMX and CVX). Furthermore, we do think this amount of fees is on trough volumes and expect volumes to rise from here when speculative demand returns. Present Perp DEX volumes are ~30% that of the historical peak in Feb ‘22. Not withstanding the fact that Perp DEX penetration is now higher and likely to go higher against the backdrop of growing CEX FUD. As such, we think its reasonable to assume that annualized fees can rise to $100m (and potentially more) in a rising market.

Investment Thesis #2: Decentralization will usher innovation.

We see the decentralization of DYDX potentially opening new verticals that were previously difficult to approach due to regulatory hurdles - products such as prediction markets, options and synthetic products. This too has been hinted in the recent DYDX presentation at the Nebular Summit.

Investment Thesis #3: Bullish unlock.

V4 together with the unlocking of investor tokens was previously slated to be earlier in 2023 but later delayed. It is evident to us that the timing of v4 has been synced to align with the unlock to ensure that new supply hitting the market would be balanced with demand from the new and improved tokenomics. We will further elaborate on this in the Mythbusters section.

Mythbusters

This section addresses what we view as common misconceptions around DYDX.

Myth #1: There is a massive unlock in December, tokens are likely to dump into that.

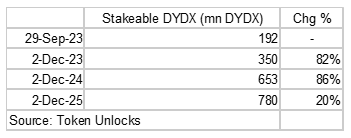

The biggest concern over the token at the moment is the upcoming December unlock. The December unlock will increase token supply by 80% and subsequently increasing it by another 80% a year after. However, we believe the concerns here are overblown and it is in fact in the interest of the team to ensure that the token is well supported into the unlocks, supporting our view of the pain trade being up.

Of the 150mn DYDX tokens that will unlock on 1 Dec 2023, 30% belongs to “Employees & Consultants”. We have already seen precedence of this as the unlock had previously been pushed back to better sync with the timing of a delayed v4; likely to ensure that there is good intersection between supply of the token coming to market and demand post value accrual.

Worth noting as well that of the “Employees and Consultant” tokens, 70% only fully unlock on 1 Jun 2024 and 90% only fully unlock on 1 Jun 2025, which leaves more time for interests to be aligned with token holders.

Myth #2: DYDX volumes are not real, there is a high amount of washtrading by market makers to earn Trading/LP rewards.

A common criticism is there is a high amount of washtrading by market makers to earn Trading / LP rewards. While it is true in the past that the value of dYdX tokens given out to traders and liquidity providers were higher than fees, this is not presently true.

In fact, we have observed a trend of both Trading / LP rewards decreasing while fees / volumes remaining sticky. Additionally, the protocol has also made a conscious effort via several governance proposals to reduce token rewards to traders and LPs, which has not resulted in a departure of trading volume.

The table below highlights how DYDX net margins (fees minus emissions) have trended into positive territory this year and the latest month being breakeven. We expect, post the reduction of LP rewards in DIP-24 that it will trend back into positive territory.

Myth #3: Perp DEX fees are expensive or getting compressed.

Our comparison of DYDX’s fees even vs CEXes indicates that DYDX’s fees are already competitive (if not more competitive) vs CEX fees and hence insulated from fee compression. In fact, we would argue that the fees are potentially considered lower given the DYDX tokens given as Trading/LP rewards.

Catalyst #1: CEX loss = Perp DEX win.

From the FTX saga, we know that perpetual DEXes tend to gain market share and token prices outperform when we see FUD around CEXs. Against the current backdrop of heightened scrutiny on CEXs, this is a bonus catalyst that we see potentially benefiting dYdX, making it a good “hedge” in a portfolio for a CEX FUD scenario.

Catalyst #2: Validator MEV in v4

An idea that has been explored recently is the ability for DYDX validators to earn MEV revenue on the exchange. We went through Chorus One’s in-depth report on MEV extraction by DYDX validators and are convinced that “validators can boost revenues by partnering with trading firms to extract MEV” further enhancing the appeal of spot buying to spin up a validator node. For context, Chorus One is one of the biggest institutional staking providers operating on 40+ Proof-of-Stake networks.

Conclusion

We see DYDX as both a trade (short-term) and an investment (long-term). In the short-term, we expect v4 to inspire a bullish unlock as fees accrue to the token and demand by validators to accumulate spot. In the longer term, we also see it as a good core position within a crypto portfolio as it has good fundamental beta to a crypto upcycle. It has real value accrual benefits from speculative volume coming back to crypto in addition to new products post v4 and Perp DEXes potentially gaining share from CEXes.

appreciat 😊