FXS: Coiled Spring

The Asymmetric Risk:Reward In Owning $FXS

FXS: Coiled Spring

Overview

This report details our investment thesis on Frax Finance (FXS) - currently one of our highest conviction ideas within the crypto space over the next 6-12 months. We see FXS outperforming the majority of other tokens in the same time period and this report serves to communicate the premise to our views.

The report is structured as such:

Investment Thesis: Where we highlight the key points around why we see an asymmetric risk:reward in buying FXS at these levels.

Value Accrual: How we see FXS accruing value over time.

Valuation: Where we employ non-academic but pragmatic methods to value FXS.

Mythbusters: Common misconceptions around Frax that are largely wrong.

Appendix: Mostly links to other useful information about Frax.

This report is the first in our research series where we will cover our highest conviction ideas - ranging from small to large caps - in a range of formats (written, video, audio etc).

While this is an in-depth report highlighting the ins and outs of the elements of Frax that are key moving parts to our investment thesis, it is by no means a full primer. We will not introduce Frax and its history and neither will we be walking through every single moving part of Frax.

However, we understand that there may be readers that need to get up to speed on Frax. As such, we have attached links to external sources (kudos to Flywheel DeFi) along the way as well as in an appendix section at the end which we believe will prove to be a good enough resource for anyone looking to start there.

1) Investment Thesis

Summary: Our investment thesis on FXS is simple. We see an asymmetric risk:reward in buying FXS given 1) the valuation support at these levels and 2) the high likelihood of significant incremental value that the market is likely to attribute to the token in the next 6-12 months.

To elaborate, we see relatively less downside in FXS’ compared to other tokens as 1) it now enjoys valuation support post the 30 Jun’23 passing of FIP-256 (more aggressive buybacks of FXS below $5) and 2) our valuation exercise (later part of the report) demonstrates how key parts of FXS have yet to be priced into the token especially given the upcoming catalysts of FraxChain and frxETH v2.

Most importantly, our observation of the team’s track record in building and shipping, gives us the confidence in execution of these above-mentioned catalysts. We see FXS, at the minimum, outperforming most other alts as FraxChain and frxETH v2 rolls out and potentially even becoming a multibagger in a bull market.

Investment Thesis #1: The Asymmetric R/R - FXS’ $4 to $5 Buyback

On 16th Jun ‘23, not long after Frax restarted its FXS buyback program with a $2mn 6-month TWAMM, we wrote a proposal recommending that the protocol optimize the design of its buyback such that the program’s objectives are better achieved. We highlighted in our proposal that a buyback program that's more aggressive at lower levels but stops when price is above the $5 level can help the protocol i) signal a valuation floor to the market, ii) acquire FXS cheap to be used in the future and iii) accrue value to protocol owned liquidity (POL).

While, on the surface, it may seem like such a proposal’s only objective is FXS price but that is far from the truth. Signaling a valuation floor to the market and consequently a strong FXS price has immense strategic value to the protocol upon deeper thought.

With ~12K of FXS emitted per day (4.38m FXS or $21.9mn at $5 FXS per year) to gauges and bribes, it is fair to say that ensuring the most efficient use of emissions should be of importance to the protocol. These are intricate cogs that power the protocol - AMOs, bribes, etc. A strong FXS price as well as warehousing FXS cheap ensures efficient functionality of these mechanisms and hence our proposal. Furthermore, we illustrate through the below exhibit that FXS is also fundamentally undervalued at the $4 to $5 level.

Given the progress that the protocol has made in its development in addition to upcoming developments, we do not think a price at the lows of the range (by itself as well as relative to other alt coins) is warranted.

The buyback proposal has since been passed on 30th June ‘23 which we see sending a strong signal to the market of a value floor when FXS is below $5. This presents a asymmetric risk:reward to accumulating FXS not only at below $5 but also between $5 to $6 given the limited downside to the “buy zone”.

Investment Thesis #2: When It Rains, It Pours - A Catalyst Blitz in the Next 6 Months

Now that we’ve highlighted how downside is limited, let's talk about the upside/growth - FXS’ roadmap in the next 6 months. We see an extremely exciting 6 months ahead for FXS which we believe will i) drive growth in value accrual metrics that the market cares about (eg. frxETH supply), ii) extend the protocol into parts that the market will ascribe significant value to (FraxChain) and iii) remove existing overhangs (eg. Frax v3 and frxGov). We have ranked these according to both significance and proximity; and they are as follows:

Catalyst #1: frxETH Adoption

For us, sfrxETH is the most exciting near-term growth engine for FXS. Granted frxETH has already experienced impressive growth since its launch, getting to $450mn TVL in staked ETH in less than 6 months. But we think there is still much room for further growth as it catches up to rETH’s $1.5bn TVL (the next highest staked ETH LST). We see two big levers in the next few months driving frxETH’s growth:

sfrxETH on AAVE: For those that remember, the looping of stETH on AAVE (a.k.a. leveraged farming of stETH) drove a huge wave of stETH supply creation and we see a similar phenomenon for sfrxETH when it gets on AAVE. The proposal to onboard sfrxETH to Aave has already been passed via a Snapshot since February and as such we see this as an imminent catalyst.

frxETH v2: One of the objectives when building frxETH v1 was to optimize for yields to the user. As it stands, frxETH v1 already boasts the highest yield amongst the ETH LSTs. As of 3 Jul ‘23, 1000 ETH staked on sfrxETH in the past 6 months generated 56% / 35% more yield than rETH (RocketPool) / stETH (Lido). Track sfrxETH’s yield vs competitors live here on this dashboard by Frax.

At present, one unit of ETH on sfrxETH will always have higher yield than one unit of ETH on rETH (Rocket Pool), stETH (Lido) or cbETH (Coinbase). This is achieved intentionally, by design, through frxETH’s mechanism where the ETH staking yields are not distributed to all of frxETH but only to sfrxETH (frxETH stakers). As such, the same numerator (ETH staking yields) are distributed to a lower denominator (sfrxETH) as not all frxETH are staked, resulting in a higher yield.

This is only made possible by a unique advantage that Frax sits on - its large stack of 3.65mn $CVX- the highest amongst protocols that own $CVX. Additionally, sfrxETH also charges same or lower fees vs most major ETH LSTs. Read “What is FrxETH? Frax's ETH Liquid Staking Derivative Explained” and “What is FrxETH? Frax's ETH Liquid Staking Derivative Explained” for more details around the mechanisms around how frxETH and sfrxETH achieve higher yield.

FrxETH v1 optimized for the user (liquidity and yields). FrxETH v2 will optimize for validators and decentralization. In other words, attracting the best validators, which will in turn result in better yields for the user. Sam Kazemian wanted a market mechanism that would prioritize “the most performant, sophisticated, and knowledgeable entities that know how to run good nodes.” This market mechanism could be based on several factors, including “MEV revenue, lowest hardware costs, highest internet speed, block propagation, attestation responses,” and more.

FrxETH v2 will introduce mechanisms to attract the best validators - namely 1) the fees (how much yield does the validators give up to the people staking their ETH - currently 90% for FrxETH and Lido, could be lower in frxETH v2) and 2) how much ETH validators got to put up (ie the leverage they get). While most staked ETH protocols currently charge a fixed fee to validators - frxETH v2 will introduce a dynamic rate - allowing validators to pay a lower fee when there are more ETH stakers wanting validators and a higher fee when there are more validators than ETH stakers.

As such, frxETH v2 will have the most competitive rates - dynamically between validators as well as ETH stakers. Additionally, validators on frxETH v2, will also allow validators to post less ETH than competing staked ETH products, making it the natural destination for the best validators . Sam Kazemian thinks that it is possible for only 4 ETH to be needed from validators to post as collateral to borrow 28 ETH. Rocketpool, a competitor, requires 8 ETH plus an additional bond of RPL. Read “Everything you need to know about FrxETH v2 w/ Sam Kazemian” if you want to dive deeper into FrxETH v2.

Catalyst #2: Collateral Ratio (CR) to 100%

When CR > 1, FXS will resume fee distribution to veFXS. Additionally, given the common (but untrue) perception that CR below 1 is potentially risky to the peg of Frax the stablecoin, this event will also assuage that misconception. We estimate that this event is within the next 12 months and will be a significant catalyst. Collateral Ratio (CR) is the ratio of non-FRAX/FXS/FPI assets backing non-POL (Protocol Owned Liquidity) FRAX. This ratio currently sits at 94.5%.

First and foremost, this ratio is not the full picture on whether Frax can possibly depeg (see Mythbusters - Myth #1 below). The collateral ratio is currently ~$16.5mn short vs $300mn of non-POL FRAX (4.5%). The variables here are mainly two: i) protocol-owned volatile assets - mostly $CVX ($13mn), sfrxETH ($7.5mn), $cvxCRV ($5mn), wBTC ($1.7mn), SYN ($1.7mn), etc - and ii) protocol revenue (~$20mn) which are mostly in $CRV and $CVX.

In other words, the pace to CR>1 is a sliding bar depending on the price of these assets. That said, we’d add that Reserve Protocols’ recent announcement of its intent to acquire an additional $20mn of $CRV/$CVX or equivalent does support the value of the majority of the assets mentioned above. The numbers in this section are as of 27th Jun 2023.

Catalyst #3: Fraxchain

Not much has been shared of Fraxchain so far but this is what we know so far:

Fraxchain will be a hybrid-rollup, an EVM compatible L2.

All Frax assets will be supported on Fraxchain natively and Fraxferry will be integrated at day 0 to ensure liquidity can be transferred seamlessly.

frxETH will be used to pay for gas on Fraxchain - which means more yield for sfrxETH every frxETH that onboards to Fraxchain reduces the available supply eligible to stake as sfrxETH.

More in “Fraxchain: The Ultimate Boost for FrxETH's Monetary Premium and Yield Potential”.

This is definitely a re-rating catalyst that isn't priced and we’re watching it closely. Low activity L2s are able to command at least ~$100mn in market cap (25% of FXS market cap), with app-chains like $INJ staging an whooping 7x return YTD (~$400mn gain in market cap) post successfully transitioning into an app-chain. Definitely a big valuation kicker when it comes.

Wen? Sam Kazemian mentioned on a recent podcast that Fraxchain would most likely be launched by the end of the year.

Rerating Case Study: $INJ’s successfully transition to an app-chain allowed it to outperform alts by 4x.

Catalyst #4: Frax v3

Frax v3 is an update for Frax the stablecoin. Little is known about Frax v3 except the following:

It is aimed at derisking FRAX, especially given the recent USDC depeg.

Not just USDC or the underlying stablecoins that back FRAX but also fully onchain trustless governance.

It will make FRAX more uncensorable and resistant to fiatcoin depegs.

It will be bullish for FXS.

Here are some snippets on Frax v3 details:

And most importantly:

Catalyst #5: frxGov

Currently, while veFXS holders are the ones voting in proposals and thereby decentralising governance of the protocol, the execution of these proposals are still done via the protocol’s multisig smart contract. The multi-sig consists of core team members of Frax such as Sam Kazemian, Travis Moore, etc.

As such, the protocol still faces a key risk if a majority of the multisig signers are unable to sign. One example of such a mounting risk is the increasingly hostile stance of certain jurisdiction against crypto. Hypothetically, if authorities were to arrest enough members of the Core Team today, it could lead to a situation similar to OKX, where the international exchange was unable to process withdrawals for several months until CEO Star Xu was released from house arrest.

While frxGov isn’t likely to drive value accrual. We’ve listed this as a key catalyst given it could alleviate certain investor concerns around the recent regulatory landscape and get more investors comfortable with owning FXS. See “Frax 101: Governance 2.0 - What is frxGov?” for more details on frxGov.

Investment Thesis #3: Sam Kazemian and The A-Team

The first part of our investment thesis highlights the valuation support (limited downside). The second part highlights the upside from upcoming developments (catalyst). However, it is this last part that we place the most weight on - which is the quality of the core team.

The team gives us the confidence that the very roadmap that we are excited about will be successfully executed on. Promises and hope are abundant in crypto but a safe pair of hands on the driving wheel is far and few. Our observation of the Frax’s core team’s track record as well as history provides us with that comfort.

We spoke to a number of people who have worked closely w the core team (even before Frax Finance) who can attest this. More details on Sam Kazemian’s background in the appendix under “Sam Kazemian”.

2) Value Accrual

Sam Kazemian has stated in the public Frax TG chat that Frax generates ~$20mn in annualised revenue, attesting to the protocol’s vigor in revenue generation. For context, this puts Frax amongst the top 30 protocols (out of 176 listed) according to Token Terminal. Frax is unfortunately not listed on Token Terminal. This section of our report aims to breakdown the key existing and future moving parts Frax that drives revenue accrual.

Value Accrual #1: frxETH

The protocol fee structure allocates 90% of all staking yield to sfrxETH stakers in the form of frxETH. The remaining 10% is split between the Frax protocol treasury (8%) and a slashing insurance fund (2%). The 8% distributed to the protocol treasury in the form of frxETH will ultimately be distributed back to FXS holders. The 2% that goes to the insurance fund will be used to cover any potential slashing events to effectively keep frxETH overcollateralized. $500mn * 5% * 8% = $2mn. While this might seem underwhelming, we have stated in the Investment Thesis section that we see frxETH catching up quickly to rETH. At rETH TVL (~$1.5bn staked ETH), the revenue accrual of frxETH to FXS is expected to be close to ~$8mn.

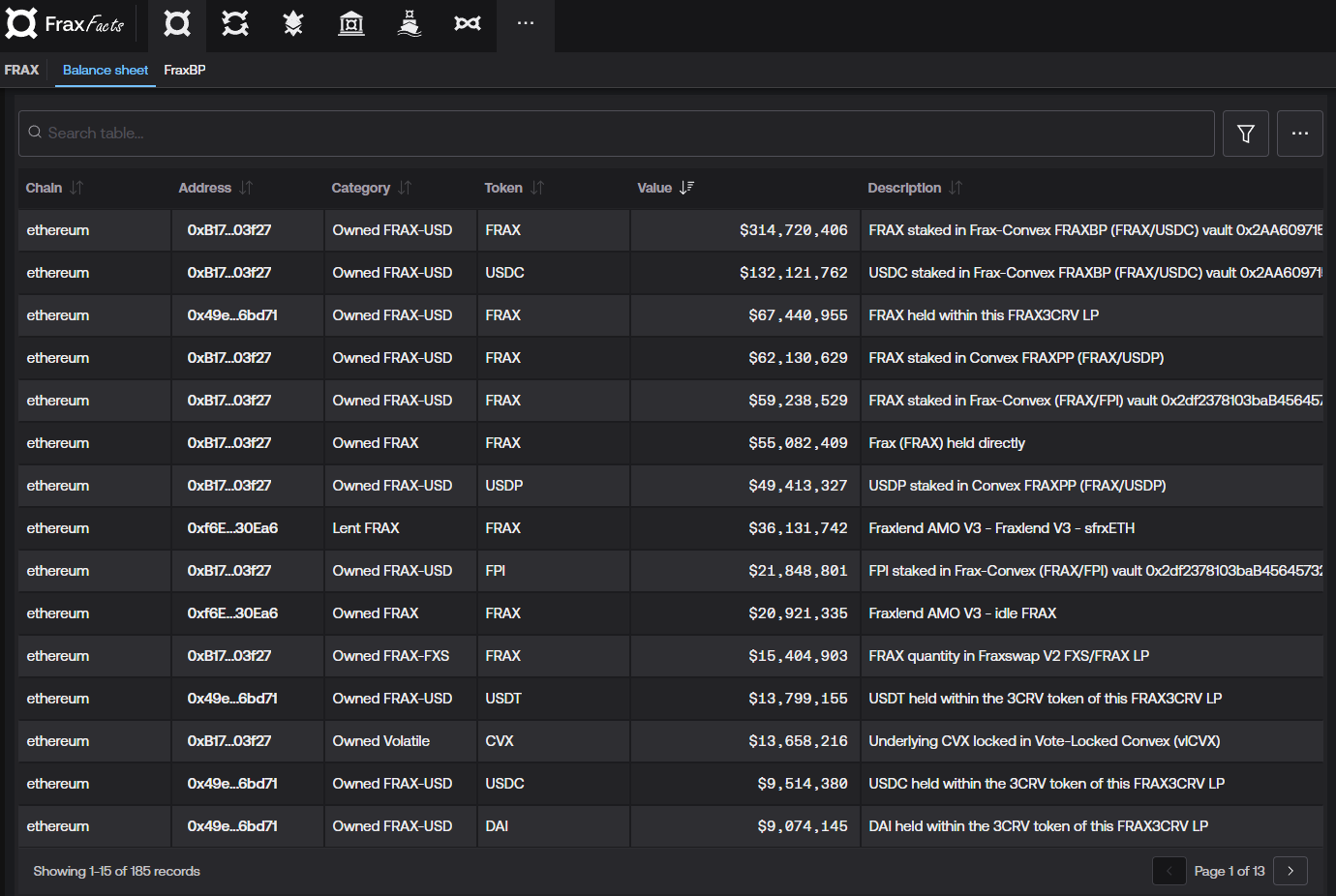

Value Accrual #2: The AMOs

The AMOs are the largest revenue driver for Frax but undoubtedly one of the most conceptually complex moving parts within Frax. As such, we have dedicated a section in the Appendix for readers who want more details on how they work. In short, the AMOs (Automatic Market Operations) have two objectives - 1) ensure peg stability of Frax native assets (FRAX and frxETH) and 2) generate revenue by putting protocol owned liquidity to work.

During this process it mints FRAX/frxETH as well as move POL around. For eg. if FRAX is off-peg on Curve (ie the FRAX/USDC Base Pool is imbalanced and has more FRAX), the protocol would withdraw protocol owned FRAX and burn it, thereby maintaining peg by rebalancing the distribution of FRAX and USDC. Likewise, if FRAX is above-peg on Curve, the protocol would mint new FRAX, depositing it into the FRAX/USDC Base Pool, and as a result allowing FRAX to trade from above-peg back to peg.

This page gives a good idea of how the AMOs deploy protocol owned liquidity.

We estimate that the major AMOs - i) Curve/Convex AMO, ii) frxETH AMO and iii) FraxLend alone generate ~$14mn in revenue (most of which are in $CRV and $CVX tokens). It is likely that ALL the AMOs combined generate closer to $16mn in revenue, considering that frxETH contributes $2mn and Sam Kazemian estimates that the protocol in its entirety generates $20mn.

Value Accrual #3: Fraxchain

With Fraxchain possibly launching before 2024, it is a future value accrual driver that we have to consider.

Presently, we know that Fraxchain will allow the usage of native Frax assets (FRAX, frxETH, etc) to be used as gas. As such there will certainly be indirect flow through to the value accrual via frxETH and Frax stablecoin.

We estimate that conservatively gas fees of FraxChain can be ~$5K/day ($1.8mn/year) in the range of Fantom, zkEVM and Osmosis. This would easily put FraxChain’s revenue at 10% of the current protocol fees (~$20mn). But more importantly (which we will elaborate in the Valuation section of our report) we see the market ascribing significant incremental market cap to FXS due to FraxChain. A phenomenon which we have seen in other successful app-chain transitions.

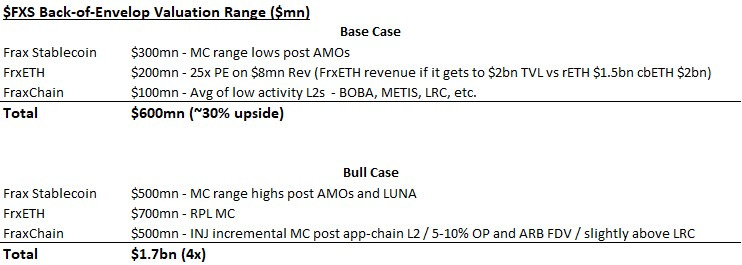

3) Valuation

As we start this section, we’d like to preface that we are not fans of employing traditional valuation models in crypto. Traditional valuation models such as target multiples and discounted cash flow analysis often have arbitrary variables that the valuation output is highly sensitive to (discount rate, multiples, TAM analysis, etc.) and are as such, to us, mere academic exercises.

However, we still see value in this section as it provides 1) context to how cheap FXS is and how much value has to yet to be ascribed to it and 2) how much upside FXS can potentially achieve in a bull market (a time where “fundamental” valuation models and imagination thrives).

We choose to view our valuation of FXS as a sliding bar of 3 key parts - i) Frax the Stablecoin, ii) frxETH and iii) Fraxchain.

As we start, on the conservative end of the sliding scale (the Base Case valuation), we value the parts as such:

Frax the Stablecoin: $300mn. This is at the lows of FXS’ market cap range post the introduction of AMOs. Given the significance of AMOs as a revenue driver (close to $20mn of revenue and majority of FXS revenue today), we think it is only fair that we adopt such a timeframe when evaluating the conservative value of the stablecoin component.

frxETH: $200mn. We ascribe a conservative 25x multiple to the estimated revenue of frxETH (~$8mn per year) post it growing to the size of rETH and cbETH. We view frxETH’s growth to rETH and cbETH as an eventuality given the superiority in frxETH’s yield; and post frxETH v2 superiority as well in decentralisation and the validators.

Fraxchain: $100mn. This is conservative given we use the average of low activity L2s such as BOBA, METIS and LRC.

The above exercise also seems to attribute each part with more value according to age which we also find sensible and adheres to the Lindy Effect.

As Frax ships, develops and the market also gaining an appetite for bullishness, we see the sliding scale moving up closer to our Bull Case valuation as follows:

Frax the Stablecoin: $500mn. This is at the highs of FXS’ market cap range post the introduction of AMOs, collapse of LUNA but pre the introduction of FrxETH as that would have priced in some element of FrxETH. We chose to take a measured approach including on the market cap range post the collapse of LUNA.

FrxETH: $700mn. On par w RPL as frxETH supply exceeds that of rETH.

Fraxchain: $500mm. This is the incremental market cap value that INJ gained post its successful transition to an app-chain. For context this is also only slightly above LRC ($300mn) and 5-10% of ARB and OP’s FDV.

As you can see from the above, in a more bullish scenario, each part is ascribed with more equal value. This makes sense as well in a bull market as participants are more willing to pay for the future and look forward; consequently ascribing more value to growth.

The back-of-envelope valuation exercise combined with this above chart from earlier in the report reinforces our view that FXS is certainly valued conservatively by the market at this point and value accretion would come as more evidence of parts (frxETH and Fraxchain) developing become apparent.

4) Mythbusters

This section addresses what we view as common misconceptions around Frax.

Myth #1: Like LUNA and other algorithmic stablecoins, FRAX runs the risk of a death spiral. Frax’s collateral ratio below 1 means it is not safe and can depeg.

Absolutely not. There is $300mn of non-POL FRAX circulating backed by $237mn of stablecoin equivalent assets and $37mn of volatile assets (eg. CVX, CRV, etc) held by the protocol. (Non-POL FRAX) / (Non-Frax/FXS/FPI Protocol Held Assets) = Collateral Ratio.

That said, there’s ~$100mn of non-POL locked FRAX/stablecoin LP locked for > 1 year. What this means is that there’s only $200mn of FRAX that can be sold into $237mn of protocol owned stablecoin equivalent assets. But what happens 1 year later? It is likely by our estimates that the protocol achieves CR>1 within a year.

Myth #2: Frax’s team being US-based means if indeed the day comes that US’ stance against crypto becomes draconian, the protocol will face an existential crisis.

As mentioned in the Investment Thesis - frxGov section above, FrxGov solves this. FrxGov once deployed will put the control of protocol fully in the hands of veFXS holders and as such there will be no centralised operational element to the protocol and should remove overhang of any sort of regulatory action against.

The existing core team will still be able to work on the protocol and have upgrades pushed through through governance proposals etc while remove risk of any regulatory action threatening the existence of the protocol.

Myth #3: Frax is a Frankenstein of forks and has little to no innovation.

Absolutely false. While some parts of Frax are not new ideas - FrxETH (Liquid Staked ETH), FraxFerry (Bridge), FraxSwap (AMM) and FraxLend (Borrow/Lend) - they are built to complement the existing Frax product. FrxETH was built with the idea of delivering the highest yields in ETH LST, leveraging Frax’s position as the largest protocol holder of CVX.

FraxFerry was built to circumvent any risk of native Frax assets (FrxETH or Frax the stablecoin) being compromised as users desire for these assets to be multichain.

FraxSwap was built to allow the protocol to effectively use its balance sheet to conduct buybacks.

FraxLend empowers the Lending AMO, allowing the protocol to mint Frax to be lent to other assets as collateral similar to a CDP.

Conclusion

We would conclude by reiterating the investment thesis that we’ve laid out at the beginning of this report. We see an asymmetric risk/reward in owning FXS over the next 6 months and even in the longer term as we’ve said that it is certainly one of our highest conviction ideas in the space at the moment.

We’ve detailed many short to medium term catalysts and developments that inclines us to own FXS but also we are also comfortable with ownership of FXS longer term given the quality of the core team and its history on executing and delivering on the growth of the protocol.

Frax has come a long way: Frax v1 (surviving the post LUNA crash and witnessing death of other algorithmic stablecoins) → AMOs (an innovative solution to peg and value accrual) → frxETH → FraxFerry (Frax’s answer to bridge exploits and CCTP) → Frax v3 + Fraxchain + more to come (frxBTC, frxBonds, etc.).

We don’t see this trend of shipping, growing and further developing the protocol to stop anytime given the team’s dedication and grit. Onwards and upwards.

5) Appendix

About Sam Kazemian

Sam Kazemian is an Iranian-American software engineer who achieved remarkable success in the blockchain and cryptocurrency industry. He pursued a double major in philosophy and neuroscience at UCLA, showcasing his multidisciplinary approach to knowledge and problem-solving. Kazemian's exceptional achievements and contributions have earned him recognition, including a nomination for Forbes 30 Under 30 in 2023.

IQ.wiki: In December 2014, Kazemian co-founded IQ.wiki, which has grown into the world's largest blockchain encyclopedia. He initiated the project from his dorm room while attending UCLA. Notably, Everipedia, the company behind IQ.wiki, attracted the renowned Wikipedia co-founder, Larry Sanger, to join as its Chief Information Officer in December 2017. The project garnered significant attention in February 2018 when it secured $30 million in funding from Galaxy Digital, a milestone covered extensively by prestigious publications such as Fortune Magazine, Reuters, and Business Insider. Everipedia's impact continued to expand with the launch of OraQles in 2020, a pioneering first-party oracle service utilized by the Associated Press for recording events on Ethereum. Under Kazemian's leadership as President, Everipedia transitioned from an online encyclopedia to a blockchain knowledge platform.

Frax Finance: In June 2019, Kazemian embarked on a new venture, Frax Finance. The team's relentless pursuit of innovation led to the launch of Frax v1, a significant milestone in the development of a decentralized and algorithmic stablecoin. Frax became the first stablecoin to combine collateral backing with algorithmic stability mechanisms. On December 21, 2020, shortly after its launch, Frax Finance had a total value locked (TVL) of over $43 million, demonstrating its immediate success. Kazemian has played a pivotal role in leading the growth of the Frax Finance ecosystem, introducing groundbreaking innovations such as Frax V2, veFXS, Frax Price Index (FPI), and Fraxswap. As of July 2, 2023, Frax Finance boasts a TVL of over $1.08 billion, solidifying its position as the 14th largest DeFi protocol in the crypto industry. The team continues to drive development with upcoming projects like Fraxv3 and Fraxchain.

Flywheel DeFi Links

Shoutout to the guys at Flywheel Defi. They are definitely one of the key community members of Frax and their content has saved us hours when putting together this report.

Here are links to their explanation of some of the key concepts in Frax:

Frax 101 - A Complete Guide to Using Frax Finance - Video tutorials and walkthroughs covering the entire range of Frax products.

Fraxchain: The Ultimate Boost for FrxETH's Monetary Premium and Yield Potential - What is known of FraxChain as of 16 Jun ‘23

What is Liquid Staking and How is frxETH V2 Radically Changing It?

Frax 101: frxETH and sfrxETH - This explains how frxETH by design 1) has higher yield than its competitors and 2) has better liquidity relative to its market cap.

Frax 101: What is FRAX? A Complete History of the Protocol's Flagship Dollar-Pegged Stablecoin

Frax Year in Review 2022: The DeFi Trinity is Born (And Then Some!) - A good recap of Frax’s development in 2022.

Best of Twitter Links

Twitter links that we found along the way to be helpful.

Good Overview of Frax by Zero_13x1(7 Mar ‘23)

Frax and its Moving Parts - Riley_GMI’s infographic on Frax (22 May ‘23)