GBTC Bullish or Bearish?

An empirical study of GBTC discount vs BTC price.

One theory that has been floating around is that the approval of GBTC’s conversion into an ETF would introduce flow into the “long GBTC short BTC perp/futures trade”. While we agree that that is true, we also think that the GBTC event is a signpost to future BTC ETF approvals, inspiring a wave of spot buy flow frontrunning the BTC ETF trade. Given that spot liquidity moves price to a greater magnitude than perp (Binance BTCUSDT spot +/-2% depth is ~$10mn vs perp ~$50mn) that would in fact be bullish.

Essentially, our view is that it is too early to be bearish. Speculative spot flow could outpace the GBTC arb trade. The “sell event” could actually come much later when the GBTC arb trade closes; when arbitrageurs redeem GBTC into spot and sell spot while buying perp/futures to cover. In this case given spot liquidity is less than perp/futures, the impact on price would then be negative.

Furthermore, yesterday, we saw the highest traded volume in GBTC in recent history ($370m was traded).

- GBTC was up 17%, BTC was also up 6%

- The discount narrowed by 7.5% from 25% to 18%

This was one of the days where we saw GBTC discount narrowing and BTC up - which got us thinking: what about the other days?

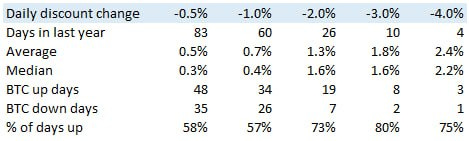

Empirical data: It turns out in the last 365 days, on the days where discounts narrowed significantly, BTC prices were also largely up.

Differently sized markets: BTC perps, by contrast trades $47b/day, >100x GBTC's volume. As such, we don’t expect the “short perp/futures” hedging flow from longing GBTC to impact BTC price much. These markets are clearly of different sizes and wouldn't expect a much smaller market to have significant impact on BTC.

good ☺️