Fun fact about myself. I used to be an aspiring semi-pro Magic: The Gathering (MTG) player and burn decks were my preferred choice of play. For those unfamiliar with the game, burn decks tend to revolve around early game metas. Dishing out quick direct damage to your opponent to end the game early. I enjoyed how mathematical and straightforward burn decks were since all you have to do to win is ensure that your deck is faster than the rest of the meta in ending the game.

One of the more well-known burn cards in MTG was Fireball which I thought was quite analogous to our investment thesis of Maker. The Fireball card is the epitome of burn cards in MTG; it was direct. It allows the player to dish out damage up to 1 minus the amount of mana he/she has. It's simple to use Fireball to win the game - accumulate tons of mana and end it with one hit. That's how we see Maker right now. It's been accumulating mana (profits through RWA) and will end game (pun intended) with the Smart Burn Engine.

Investment Thesis #1: Smart Burn Engine = Big Buybacks.

At the core of our investment thesis is the Smart Burn Engine proposal which will restart the buyback program. When initiated, the Smart Burn Engine will use excess DAI from the Surplus buffer to buy MKR token. These bought back MKR tokens are then paired with DAI into a Uni v2 LP pool.

$16m of buybacks in the first three months. Maker had previously switched off its buyback and burn program on 1st Feb 2022. Back then, the protocol was annualizing $20mn in profit in the month preceding the end of the previous buyback and burn program. Today’s profit run rate is 4x this ($86m) and half of it will be directed to buying back MKR tokens post the Smart Burn Engine proposal. Furthermore, we are expecting the profit run-rate to go to $120m largely due to RWA vaults (more on this later). To put into perspective, this ranks MKR amongst the top 3 highest earning protocols amongst Token Terminal’s >150 listed protocols. From a buyflow perspective, we are expecting $8/5/3m worth of MKR buyflow in the 1st/2nd/months after.

Thicker liquidity on the way up. The new Smart Burn Engine proposal also increases MKR’s liquidity as it buys MKR. As such, we do not view this as a mere resumption of value accrual or “price up” mechanism but a bigger and better tokenomic upgrade and consequently a re-rating catalyst.

Up early, up only, up often. The gradual appreciation of MKR price together with price stability as liquidity thickens on its way up is the embodiment of up early, up only, up often and should induce a flywheel and re-rating. We’ve seen this similar phenomenon in our experience as advisors to Radiant. In RDNT v2, Radiant required the locking of 80-20 RDNT/ETH LP for users to receive emissions as well as protocol fees. The result was massive RDNT buy flows. Token was 5x at the peak post the introduction of such a mechanism. Our modelled buyflows implies $8m/$5m/$3m in the 1st/2nd/months after, suggesting that this could have a bigger impact.

Investment Thesis #2: RWAs driving fees.

“USDC is a large single-asset exposure on Maker’s balance sheet - and pays no yield.” - Allan Pedersen CEO Monetalis

Profitability has 4x’ed and more to come. In the past 2 months (since May ‘23), Maker has experienced a phenomenal 4x in its profitability. Estimated annualised profit went from $20mn on 1st May ‘23 to >$80mn on 11th July ‘23. This is remarkable growth directly attributable to the shift towards RWAs (mostly T-Bills) as collateral. As early as late 2022, Maker started allowing RWAs (most US treasuries and some IG corporate bonds) to be collateralized for the minting of DAI, which essentially allows Maker to generate additional income vs. unproductive stables.

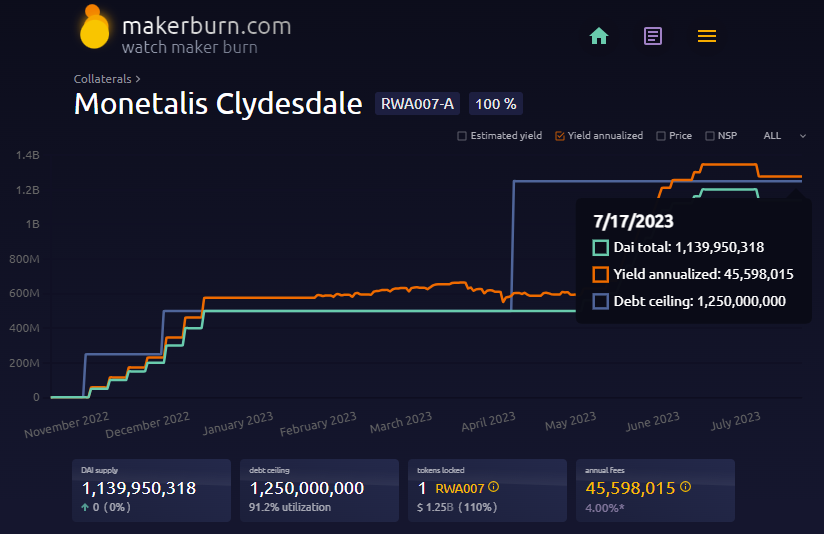

Monetalis Clydesdale (MC), a RWA vault with high quality liquid bond strategies (mostly US T-Bills) managed by Monetalis, pioneered this charge, with the MC vault reaching a 500mn DAI ceiling in Dec‘22 and 1.2bn recently in Jul‘22. The MC vault now generates a whopping $45mn in annualized revenue for Maker. And this isn't stopping anytime soon.

Another similar vault, BlockTower Andromeda has only recently been introduced (June ‘23). It only just started minting DAI, 300mnn DAI as of 11th Jul ‘23, but has a max debt ceiling of $1.28bn. In other words, there’s still 950mn of DAI or $42.5mn (4.5% * $950mn) of future profit yet to be baked into Maker’s annualized profits. This brings annualized profits easily to $120mn (all of which to accrue into MKR token buy flow through the Smart Engine Burn).

Of course, our buyback assumptions profits flatten out after these two vaults are filled. But it can ensue as long as demand to collateralize T-Bills to mint DAI persists, suggesting there is probably some unbaked upside to be had.

Investment Thesis #3: sDAI Looping.

sDAI looping is essentially depositing sDAI (yielding at 3.49% DSR) -> borrowing other stablecoins at lower rates -> buying more DAI -> rinse + repeat. This process increases the supply of DAI, thereby increasing the amount of revenue Maker can make.

System-wide borrow for stablecoins is currently high (AAVE USDC borrow is currently ~3.5%), this precludes looping (you need a good spread between DSR and other stables borrow rates). But we foresee protocols to soon emerge that will enable the looping of sDAI (similar to MIM), consequently driving supply growth of DAI and revenue of Maker.

This in turn drives more revenue generation at the protocol through the RWA.

Demand for sDAI = demand for DAI.

Incremental demand for DAI is likely to be facilitated through the PSM - ie. depositing USDC to receive DAI.

The USDC in the PSM in turn would find its way to the RWA vaults.

RWA vaults mint DAI to be given to the vault counterparties such as Clydesdale or BlockTower Andromeda, which will trade the minted DAI for USDC (through the PSMs) to be off-ramped to purchase T-Bills.

This is a view which we believe the market has still yet to priced and has missed out on.

Investment Thesis #4: Still Cheap. Room for Re-Rating.

Despite MKR’s recent rally from $680 to $900, we still dont think the Smart Engine Burn has been adequately priced in.

Despite annualized profit 4x-ing YTD (and by our estimates 50% more growth) and being on the precipice of a major tokenomics upgrade, MKR still trades at the low of its multiple range (10x P/E). This compares to 20x P/E that MKR used to trade at during the buyback and burn era. Additionally, our conversations with other traders/investors suggest that while most are aware of the Smart Burn Engine catalyst, they aren’t aware of the exact details and the size of the buyflow about to come. Hence, we are of the view that the despite the recent outperformance, the market is still not yet well positioned for the event.

We also see MKR as having good beta on the RWA narrative. Although strictly speaking, Maker is not bringing RWAs on-chain (and is thus not really listed as having RWA TVL despite having exposure to $Xb of RWAs in its balance sheet), using RWAs to generate revenue will likely resonate with TradFi institutions (which we know are entering the space via ETFs).

Appendix

https://vote.makerdao.com/polling/QmQmxEZp#poll-detail - Smart Engine Burn poll

https://makerburn.com/#/dsr - Dashboard to track DSR TVL

https://forum.makerdao.com/t/introduction-of-smart-burn-engine-and-initial-parameters/21201 - Smart Burn Engine Proposal

https://makerburn.com/#/collateral/rwa015_a - Dashboard to view BlockTower Andromeda debt ceiling vs Dai minted vs max debt ceiling.

https://forum.makerdao.com/t/clydesdale-vault-hq/17923 - Main thread for Monetalis Clydesdale vault

https://forum.makerdao.com/t/mip65-monetalis-clydesdale-liquid-bond-strategy-execution/13148 - Monetalis Clydesdale initial proposal

https://forum.makerdao.com/t/real-world-asset-report-2023-01/19934 - MakerDAO RWA reporting

https://forum.makerdao.com/t/stability-scope-parameter-changes-3/21238 - Stability scope parameter change (3.49% to 3.20%)

https://forum.makerdao.com/t/investing-our-liquidity-in-short-term-etf-managing-psms-exposures/10891/20 - Maker’s idea to invest liquidity into RWA started as early as 2021

https://forum.makerdao.com/t/mip105-the-real-world-asset-collateral-scope-framework/19688 - Defines the principles and processes related to the practical implementation of Real-World Asset Collateral allocation ( see 6.4 for approved types of RWAs)

Roadmap for Endgame

https://forum.makerdao.com/t/the-5-phases-of-endgame/20830 - The 5 phases of Endgame

5-Hour Interview w Rune on Endgame

https://twitter.com/tokenterminal/status/1667562050984243202?s=20 - TokenTerminal interview with Rune on EndGame

https://www.dlnews.com/articles/defi/maker-endgame-reorganizes-defi-protocol-with-big-changes/ - Rune’s DLNews Interview on Endgame

https://www.dlnews.com/articles/defi/makerdaos-endgame-plan-in-five-steps/ - Rune lays out the five steps of MakerDAO’s Endgame plan

https://twitter.com/wallfacerlabs/status/1653814784494829569?s=20 - Good thread summarizing EndGame and SubDaos

https://twitter.com/hexonaut/status/1676572285115813889 - 1Inch moving 20m into DSR

https://twitter.com/WuBlockchain/status/1632560608171429888?s=20 - Rune sold LDO, bought maker then sent to Multisig 0xf65475e74c1ed6d004d5240b06e3088724dfda5d

How is the new DSR rate (3.5%) financed?

Raising DSR from 1% to 3.49% (Proposal to potentially reduce to 3.2% https://forum.makerdao.com/t/stability-scope-parameter-changes-3/21238 )

The Maker Protocol, which generates substantial revenue from real-world assets and stablecoin sources, is redirecting this revenue to all DAI holders who choose to deposit into the DSR.

The Stability Fee of MakerDAO will also increase accordingly, making it more expensive to borrow DAI (interest rates for DAI)

MakerDAO will earn the net interest margin - the spread between the interest borrowers pay (stability fee) and the $DAI Savings Rate (DSR)

https://twitter.com/MakerDAO/status/1669710346003808256?s=20

Maker derives revenue from 3 sources:

- Net Interest Margin - the spread between the interest borrowers pay (stability fee) and the $DAI Savings Rate (DSR)

- liquidation revenues (fees on liquidated CDPs)

- stablecoin trading fees from the Price Stability Module (or PSM)

Source:

Lending income has been taking up the bulk of Maker’s PnL ranging between 1.6m to 3.7m monthly

Source: https://dune.com/SebVentures/maker---accounting_1

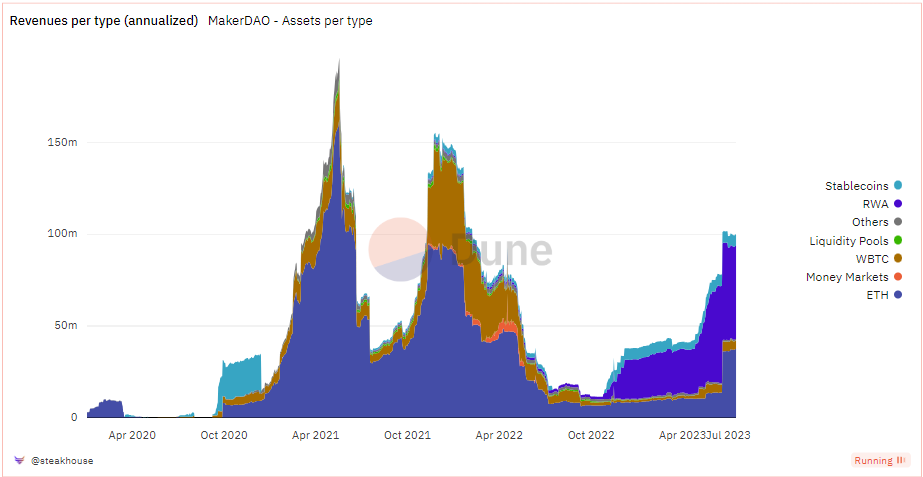

Revenues per asset type

RWAs account for majority of the revenues (up to 50.6%)

ETH is the next largest revenue driver accounting up to 37.2% of revenues

Top revenue generator comes from “Monetalis Clydesdale”

Estimated yield from purchasing iShares treasury bonds ETF is around 4%, accounting for around $45mil fees annually

(Source: https://makerburn.com/#/collateral/RWA007-A)

PowerBI dashboard on Maker’s financials

Net interest revenue takes up the largest % of revenue at 14.4m in 2023 so far

(Source: https://forum.makerdao.com/t/maker-transaction-level-accounting-dashboarde/19143)