Ouroboros Catalysts Issue #4: End of Blur season 2, CoW Swap fee switch

We first released this article on 15 Nov'23 to Ouroboros Lifetime Access Pass holders who get early access to our writing.

Last week, we flagged 3 significant upcoming events: 1) Upbit conference, 2) HFT token unlocks and 3) Butter Finance's impact on AURA (Butter was discontinued, so this didn't work out well).

This week, we will be examining the following catalysts:

Blur's Season 2 Airdrop

CoW Swap's fee switch

None of the following is financial advice.

Catalyst #1: Blur Season 2 Airdrop

Catalyst: Blur season 2 started in Feb'23 and is set to conclude on 20 Nov’23, where an estimated 300m BLUR tokens ($53m) will be airdropped to users of the platform (this comes from the red portion in the tokenomics chart below). This is slightly less than the airdrop in Blur Season 1, where 360m BLUR tokens were airdropped just before season 2 began.

On 20 Sep'23, nftstats.eth posted about bidders / farmers collectively accruing realized losses exceeding 45k ETH ($89m) and more in unrealized losses. Given that prices have increased since then, these losses would probably have decreased but are nevertheless still significant. Similar to how DeFi farmers sometimes accept negative returns to earn and sell incentives, we do expect to see some selling of the airdrop.

Intuitively, such a large unlock should result in price falling. That said, we do recognize that recent unlocks (APT, DOT and even BLUR in Jun'23) have been positive for price action. Open Interest has also increased with futures CVD decreasing, suggesting some hedging activity. We also expect Blur to announce Season 3 and other feature launches (fee switch, mobile app, etc.) as Season 2 comes to an end.

Potential trade idea: Long BLUR if price falls on airdropping. While we are less decided on BLUR's price, we think the airdrop will result in some form of wealth effect amongst NFT traders who will likely deploy capital into NFTs (and potentially friendtech too). Given the low liquidity of the NFT market ($16-17m), we expect to see some NFT collections and friendtech profiles rising.

When: 20 Nov’23

What to watch out for: The claim rate of BLUR airdrops and CEX sends.

Catalyst #2: CoW Swap fee switch

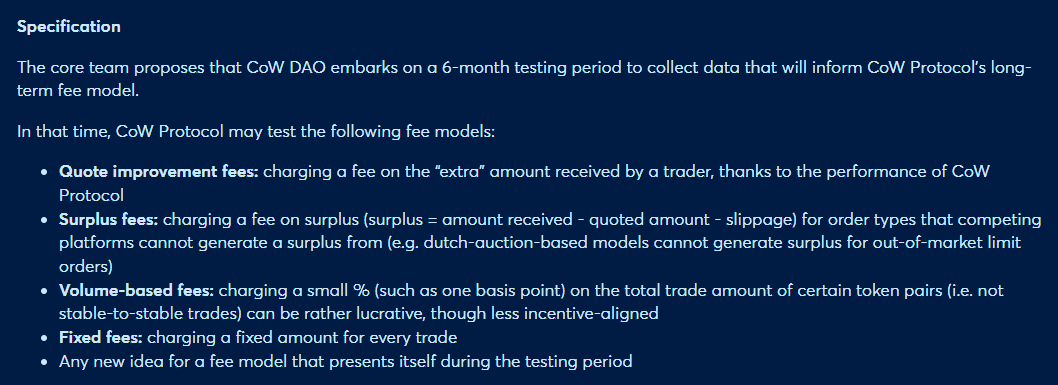

Catalyst: CoW Swap's core team has recently put up a forum proposal to start testing fee models for 6 months. The primary rationale for turning on the fee switch is to generate additional revenue which can be used "to accelerate the development of CoW Protocol, to acquire new users, to fund token utility, and more".

CoW Swap processed $1b in volumes in Oct'23 and is processing a run rate of $1.9b in volumes in Nov'23.

Assuming fees are around 0.05%, we estimate Fees/MCap APY of 17% based on Oct'23 volumes and 32% based on Nov'23 run-rate volumes. We think anything above 10% APY is attractive.

Potential trade idea: Medium term long on COW as it tests different variation of fee switches.

When: Next 6 months

What to watch out for: Fees generated as a result of turning on fee switches.