Ouroboros Flows & Positioning Chartbook #8

We released this article one week prior, exclusive to Ouroboros Lifetime Access Pass holders.

Welcome to the weekly Ouroboros Flows and Positioning Chartbook, a weekly compendium dedicated to providing a balanced view of the most noteworthy Flows and Positioning charts. None of the following is financial advice.

Its been a month since our last issue and man has it been an eventful month.

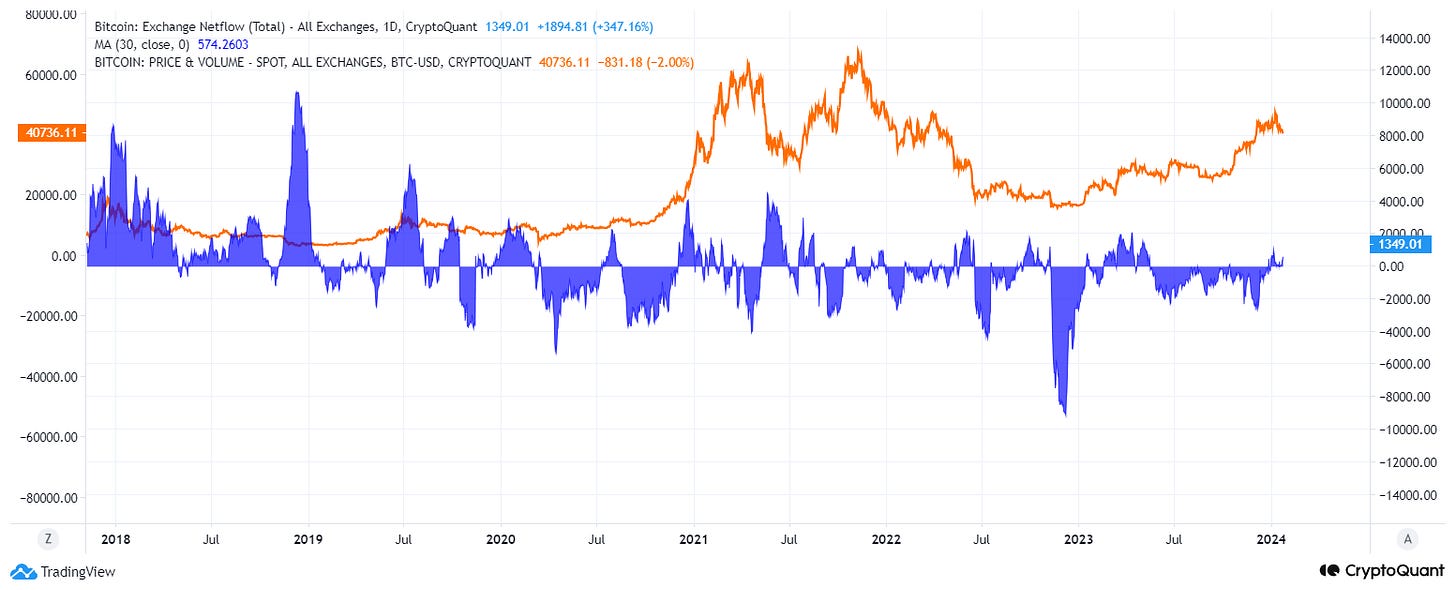

- BTC ETF got approved

- BTC didn't manage to break to a new high since the approval

- FTX made the headlines again selling $1bn of GBTC

- GBTC outflows is now the largest overhang - it continues to outpace new creations amongst the other ETFs

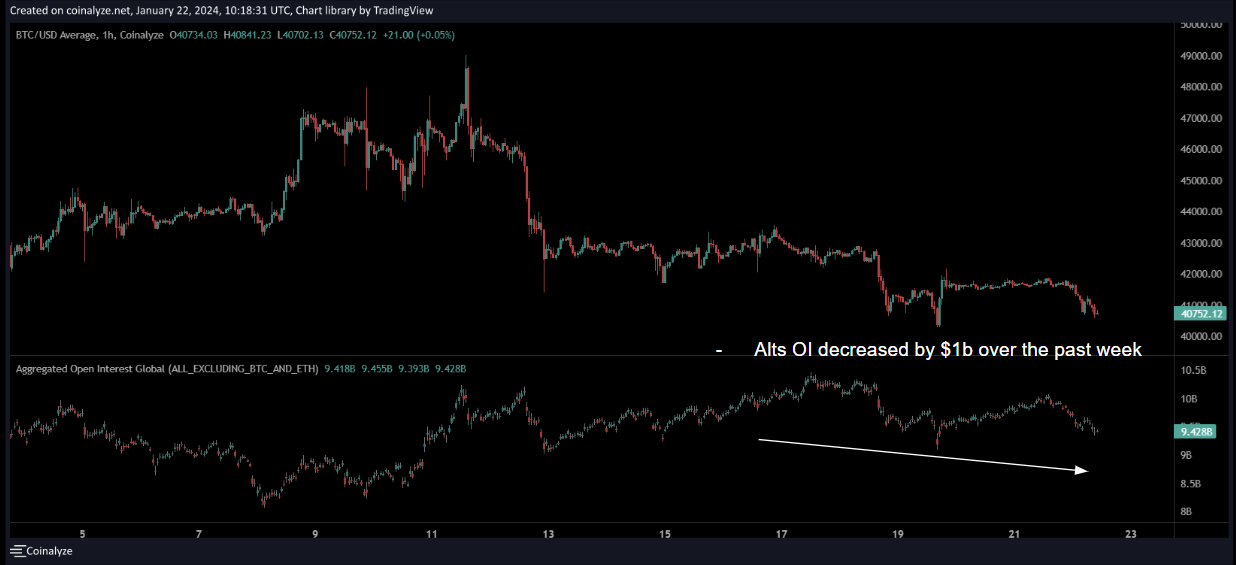

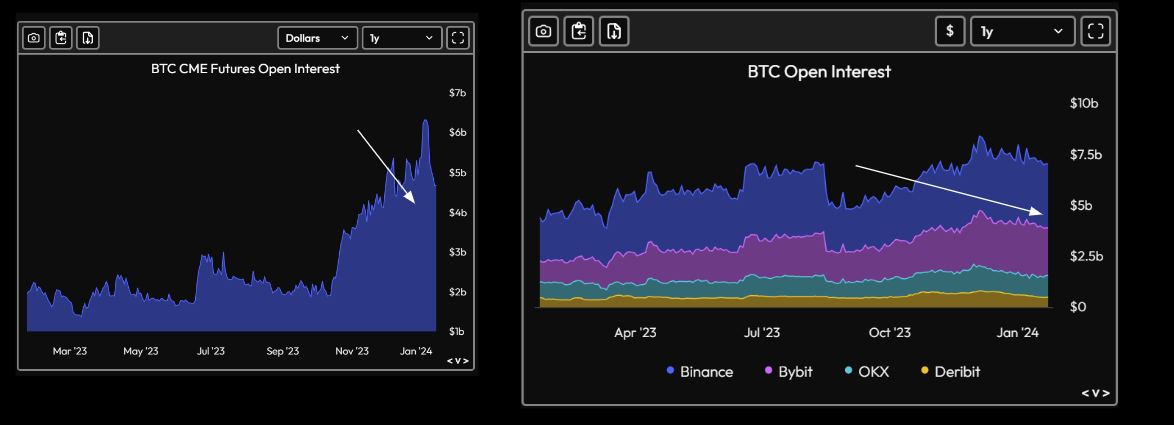

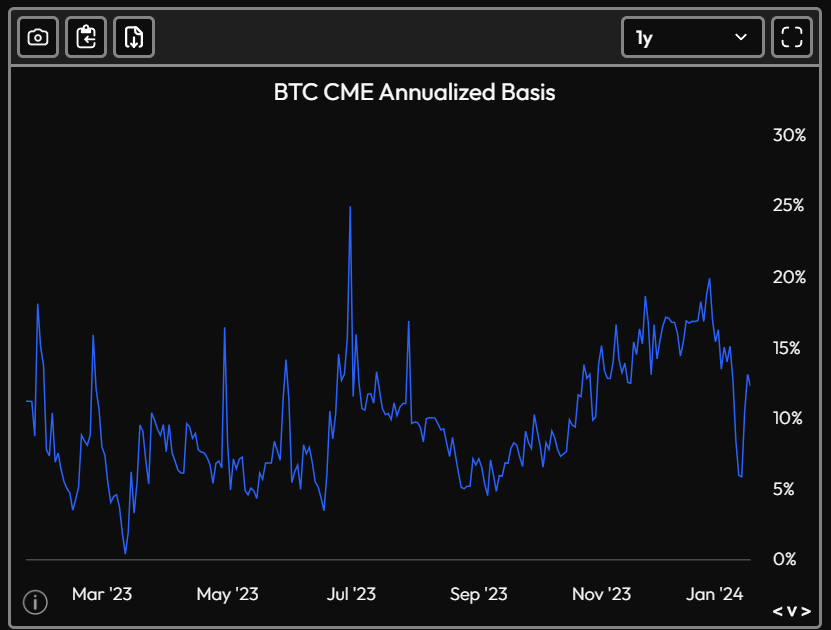

- Expectedly, the elevated CME OI into the ETF approval continues to come off

All of the above being said, we are of the view that 2024 will be a buy the dip year. While we have been in the "sell the news" camp re the BTC ETF, we are also of the view that post the ETF, there exists stronger than before dip buying floor. Pools of TradFi capital previously unable to access BTC as an asset class now can. Think endowment funds, traditional long-only funds, insurance money etc. We will see new TradFi main characters advocating for BTC post accumulating it. It will play out quite similarly to how PTJ and Druckenmiller spoke about BTC a couple of years back but this time it will come from the mouths of more traditional funds (vs hedge funds) that have larger distributions to retail.

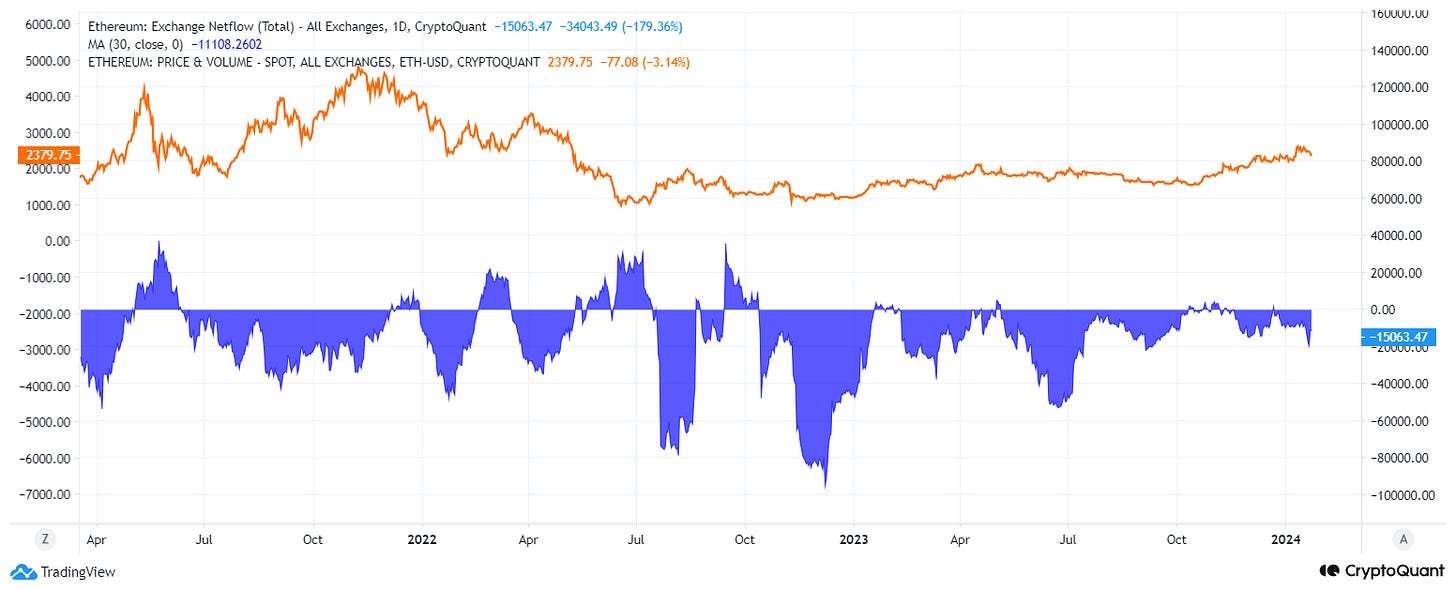

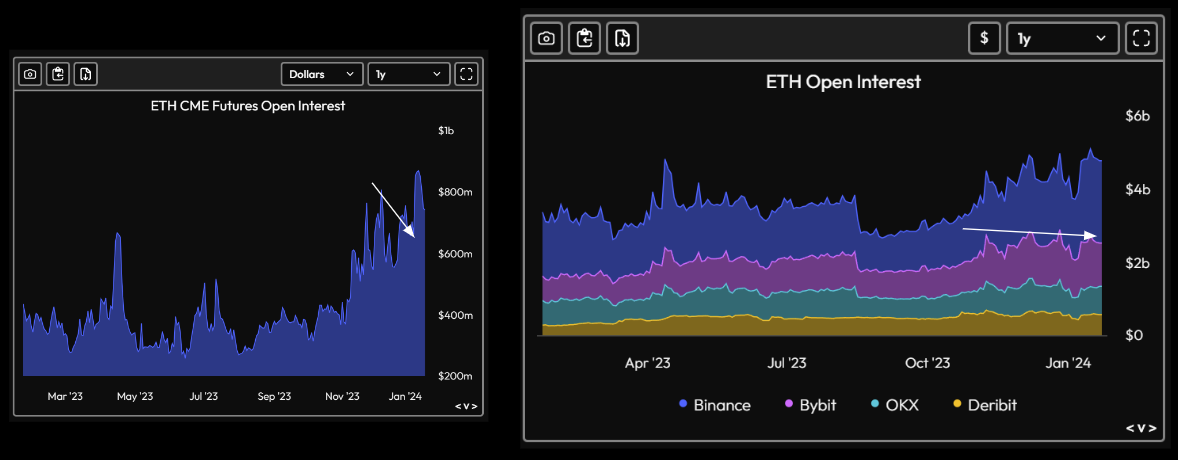

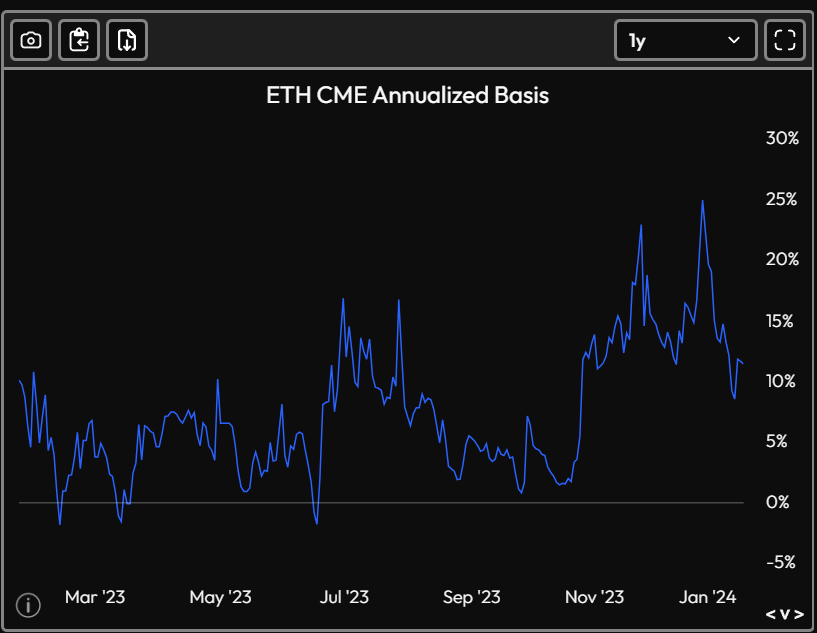

As such, we are now 80% net long with a preference for catalyst and narratives. The Ethereum ETF's approval (est. May) coinciding with the Dencun upgrade (1Q or 2Q) compels us to find asymmetric bets in that category - ARB, OP, FXS, BLUR and MATIC being some of the names. EigenLayer is another thematic that we are also watching closely and looking to buy dips on names such as LDO and PENDLE.

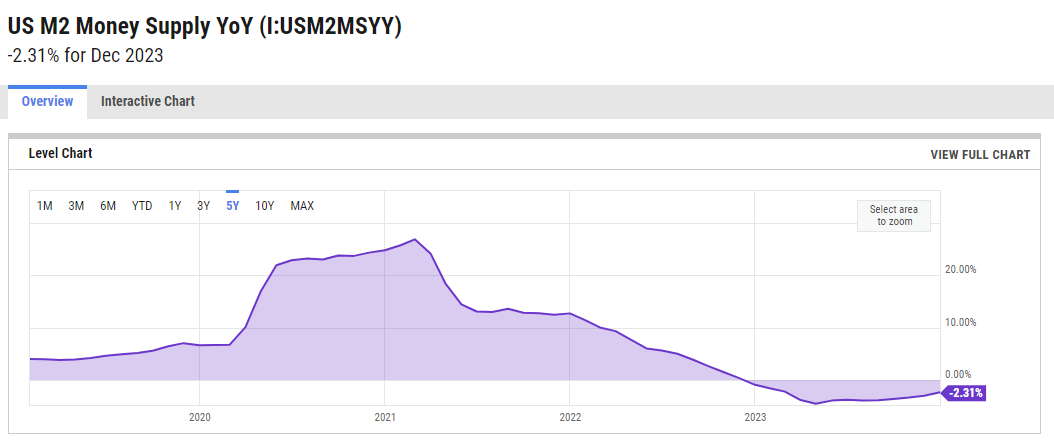

Gun to head, I do see 2024 being a significant up year, but multi-baggers will likely come in specific sub-sectors and exist in short mini-cycles. Point being, I do not think we'll see a bull market similar to 2020/21, where a rising tide lifts all boats and all tokens go on a multiple X/up-only path. 2020/21 was unique in the sense that it had the confluence of WFH, loose monetary policy and new innovations in crypto coming in successions (e.g. DeFi, GameFi, algo stablecoins, NFTs, etc.). It is unlikely that we see such an episode again anytime soon but it doesn't mean there are no more 10-100x opportunities (they will just be harder to find).