Ouroboros Flows & Positioning Chartbook #5

We released this article one week prior, exclusive to Ouroboros Lifetime Access Pass holders.

Welcome to the weekly Ouroboros Flows and Positioning Chartbook, a weekly compendium dedicated to providing a balanced view of the most noteworthy Flows and Positioning charts. None of the following is financial advice.

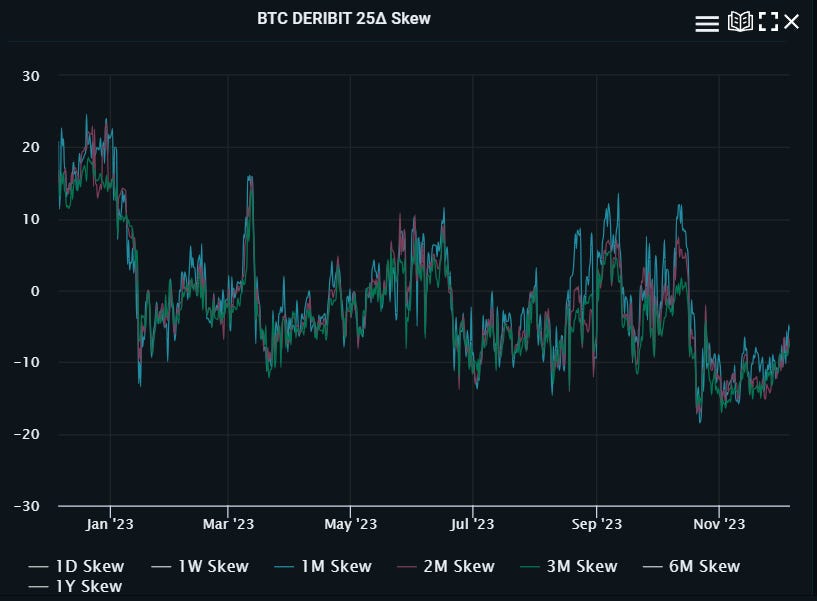

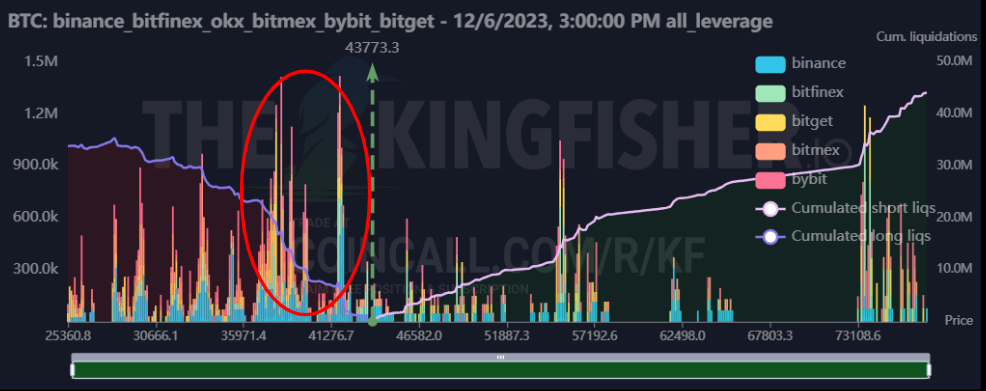

We made a significant change in our book's positioning this week, flipping from flat to 50% long as BTC.D rises to new highs. We covered all of our shorts and continue to hold core longs of FXS, RLB and RDNT. We observe that over the past year, new highs in BTC.D to usher in mini alt-szns. That said, it is important to recognize that some of these alt szns can be as short as 1-2 weeks, hence requiring the need to be nimble. We hold the view that this could particularly be the case in the current setup (heavy positioning) as we face a potential "sell the news" event into the 10th Jan's BTC ETF headline.

PS: We took profit on DOGE this week at $0.1.

Incremental observations this week:

Liquidity

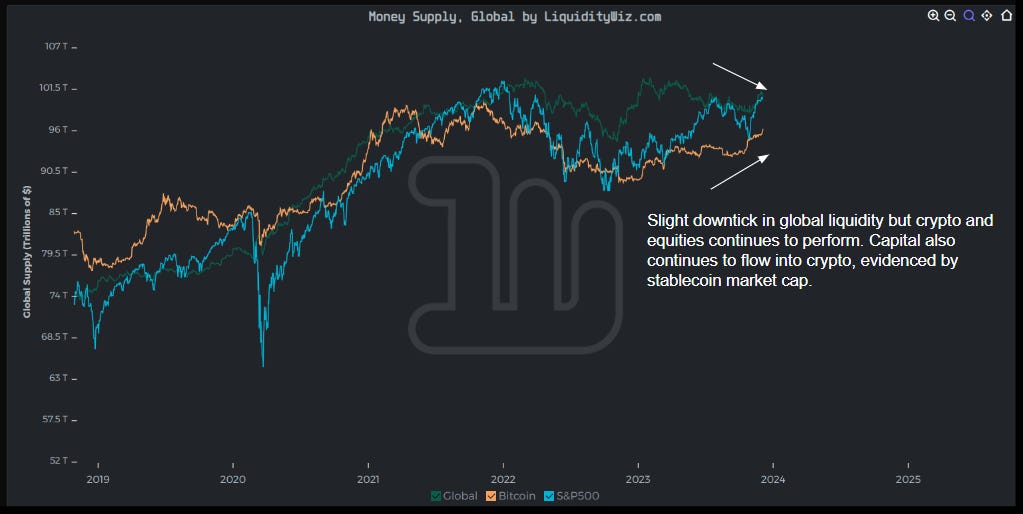

- Capital continues to flow into crypto evidenced by stablecoin's market cap going up.

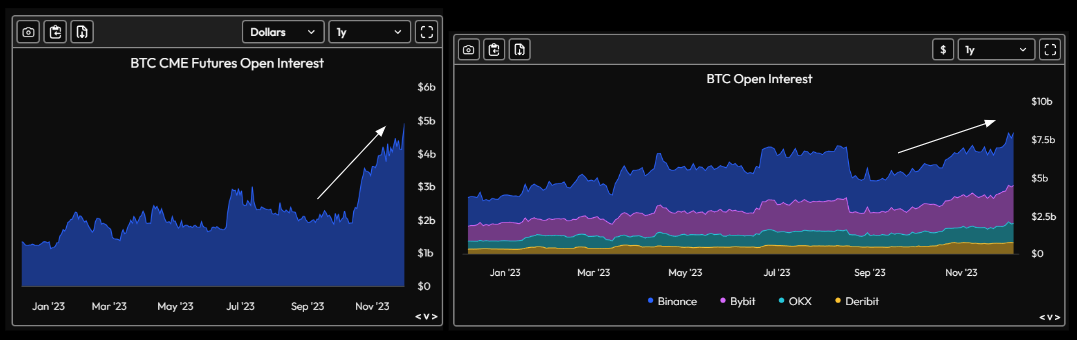

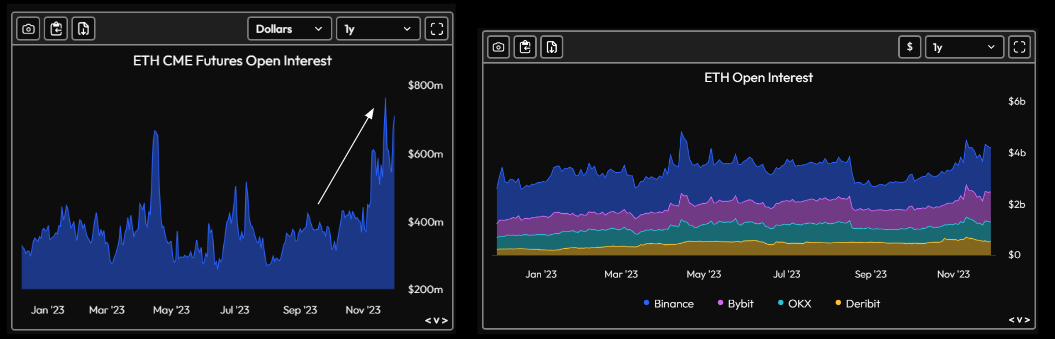

OI and Funding

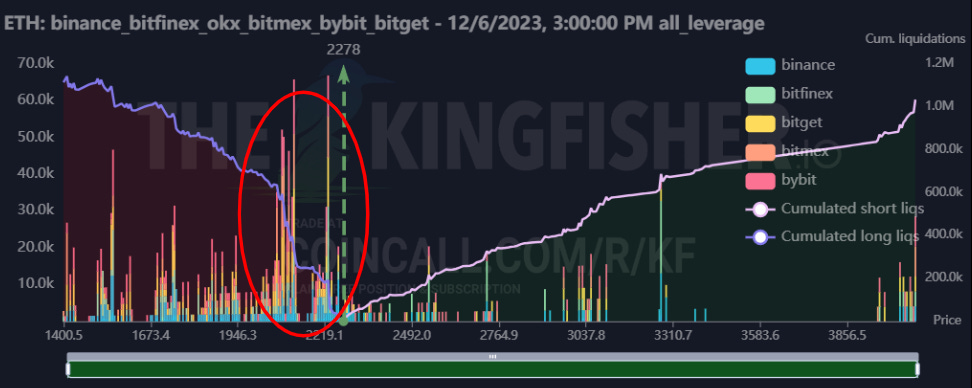

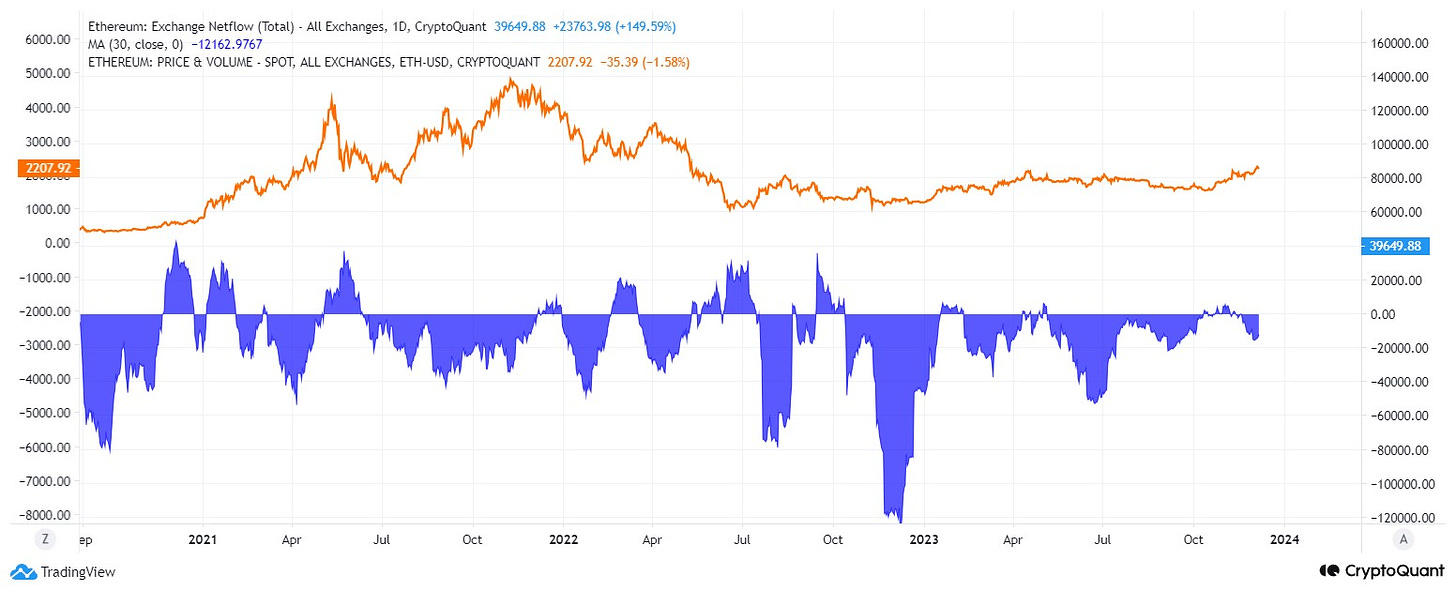

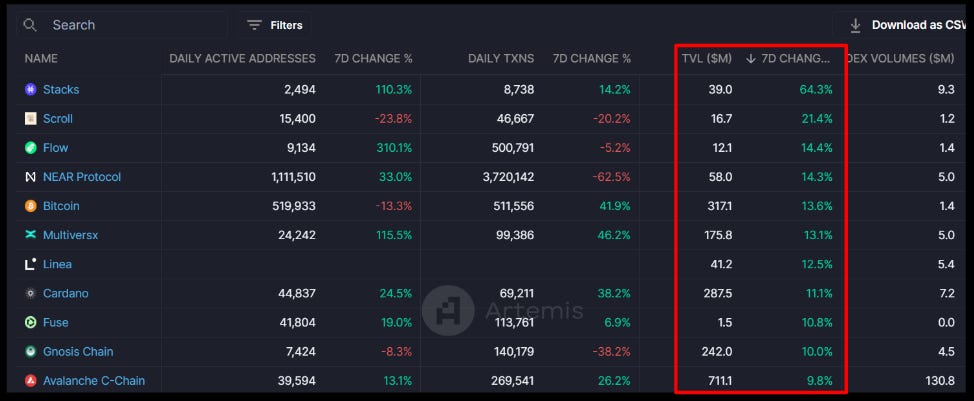

- Evidence of interest rotating from BTC to ETH and alts as BTC perps OI decreases while ETH and alts OI increase.

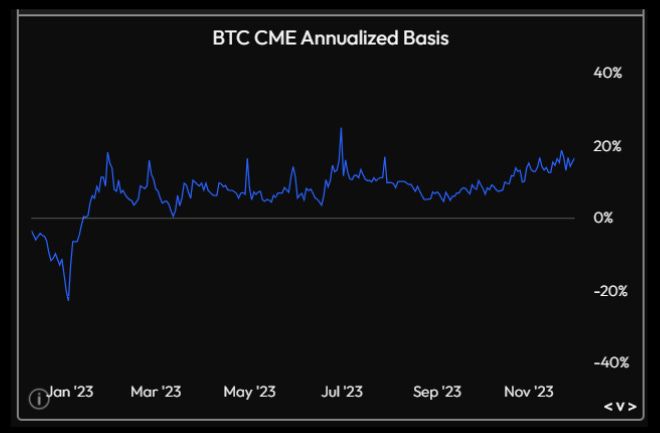

- BTC CME OI hitting new highs while ETH CME OI got flushed but recovered back close to highs, funding rates becoming less positive (less leveraged longs).

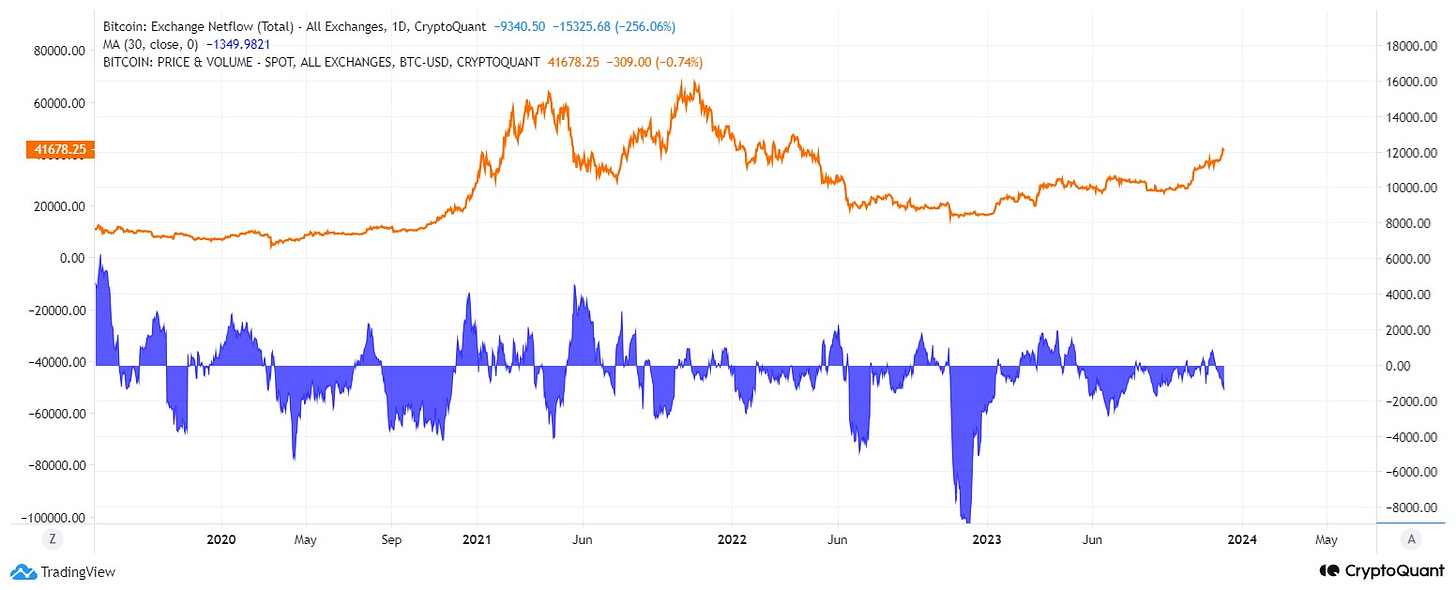

Flows

- Market appears to be in a risk-on mode as stablecoin dominance broke lows despite stablecoin market cap rising.