Ouroboros Market Update #4: Governance token for mETH, GMX expanding to Solana, Infinex's lockdrop

Mantle's new token for mETH, GMX's expansion to Solana and calculate the yield for Infinex's lockdrop. This article was first available to OLAP holders on 20 May'24.

In OMU #3, we cover Renzo's airdrop, which has traded much worse than we had expected, largely because of broader market weakness. We also wrote about LRT depegs - most LRT projects have made steps towards enabling withdrawals and ezETH's peg has largely recovered.

In this issue, we cover what Mantle's new token for mETH means for mETH yield, GMX's expansion to Solana and calculate the yield for Infinex's lockdrop.

#1 Governance token for Mantle's mETH: +7% to mETH yield

Governance token for mETH. A proposal on Mantle's governance forum details the spinout of MantleLSP (Mantle Liquid Staking Protocol), introducing a new project token and expanding into liquid restaking.

Key Points:

Product Expansion: MantleLSP will allow mETH restaking, returning a receipt token cMETH.

Tokenomics: Mantle Treasury - 30%, Core Team (1-year cliff, 3-year vesting) - 10%, Private Sales - 10%, Treasury - 50%.

Governance: Initially managed by Mantle's core team with potential $5M financing, transitioning to a DAO framework.

Go-to-Market: Points campaigns for mETH and cMETH holders, convertible to ProjectGovTokens, with development, operations, and distribution partnerships. Rewards for points programs will come from the 50% allocated to the new project treasury.

Farming mETH. We expect the project to retroactively reward mETH past holders. Historically, mETH has had an average TVL of ~$1b (since its launch in 4Q23) while its current TVL is 460k ETH ($1.4b). Assuming 1) TVL doubles from now until TGE as a result of cMETH, and 2) TGE occurs end of Sep'24 with 10% airdropped to holders and 3) $FDV of $1b, we expect the additional yield on mETH to be ~7%, which can be boosted with leverage on INIT by up to 5x.

#2 GMX Proposal to launch on Solana

Actionables: Wait for GMSOL points details

GMX proposal to expand to Solana. A proposal has been put up on GMX's governance forum asking for GMX DAO to cover audit fees of GMSOL, as well as granting a license for the replication, use, and front-end code. While this initiative is not led by GMX's Core Contributors, GMSOL said they are in close communication with the team. There is no announced timeline for the launch - the team suggesting there are multiple rounds of audit before GMSOL is ready.

Key details:

Independent Project: GMSOL operates independently but maintains a close relationship with GMX, exclusively using the GMX token for value measurements and storage.

Buyback Mechanism: A portion of fees will be used to buy back GMX, establishing the GMSOL Treasury, which will be overseen by the GMX DAO. The exact fee distribution mechanism will be disclosed after the audit is completed.

GMSOL Points: GMSOL points will feature no pre-minting or pre-sale. The GMSOL Treasury will back these points. Rules for GMSOL Points will be disclosed before launch. Developers and community members can contribute to GMSOL's development and earn GMSOL Points; contributions include beneficial proposals, development, and comprehensive requirement documents.

#3 Infinex Lockdrop: 200%+ yield

Actionables: Farm Infinex's speedrun the waitlist lockdrop

Lockdrop for governance NFTs. Infinex is currently holding a lockdrop that rewards users for depositing USDC. The program lasts 30 days and will reward users 377m / 600m GP (Governance Points). The 600m GP can then be used to mint 3% of Patron NFT (supply of 100,000) which gives governing rights. While there is no public valuation yet, Infinex's team has been using a $500m valuation as an assumption. This essentially means 1.9% of the project or $9.4m worth of tokens are being given out in this lockdrop.

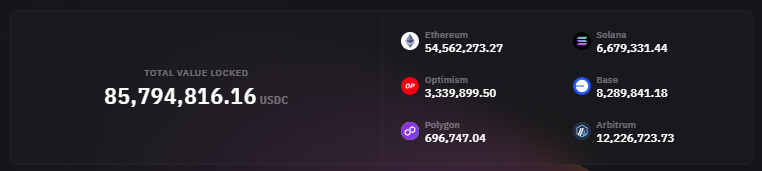

280% lockdrop farm. There is currently $86m worth of USDC deposited, of which ~$35m is reserved for a segregated whales pool, which does not earn from the 377m GP pool. This implies only $51m of TVL is farming the lockdrop at an APR of 220%. As the pool grows, yield falls though we still expect the farm to yield more than 100%.

Disclosure: The opinions expressed in this research piece are solely those of the author(s) and do not constitute financial advice. Ouroboros Capital may hold position(s) in the token(s) mentioned in this research articles. These position(s) may influence the author's perspective and analysis of the token. Readers are encouraged to conduct their own research before making any investment decisions.