STX + ALEX: The Nakamoto Upgrade - The Big Bang Moment

BTC tends to perform well post-halving. STX and ALEX provide upside beta and strong catalysts. This article was first available to OLAP holders on 28 Apr'24.

TL;DR: While the Bitcoin halving is behind us, the Nakamoto upgrade (a Bitcoin L2 upgrade exclusive to STX) is upon us. We believe market has not fully appreciated the significance of the Nakamoto Upgrade which will see both STX and ALEX re-rate. Separately, we anticipate that sBTC, a permissionless and trustless Bitcoin wrapper on STX, will play a crucial role in acquiring TVL on STX.

Our bullishness on STX is premised on:

Faster chain enables dApps: The chain will become significantly faster, unlocking DeFi applications

STX halving: $73m of sell pressure a year is removed

sBTC growing TVL (base case: $1b): Built by Stacks, sBTC's trustless design (peers have trust-based designs) should unlock BTC liquidity onto Stacks DeFi

Best in class: Compared to its peers, Stacks is the most adopted smart contract Bitcoin L2

Halving tailwinds: Bitcoin Halving = 1.5 years of strong BTC price action. STX tends to outperform BTC on the upside

We also like ALEX, the largest dApp built on STX:

Upside beta to STX which has upside beta to BTC: If the chain does well, the main dApp tends to do well

Potential airdrops: ALEX has higher ambitions and has been incubating several other projects which include: 1) XLINK, a Bitcoin L2 bridge, 2) Gaze: An index network on Bitcoin, and 3) Lisa: LSTs for Bitcoin L2s. We speculate the ALEX token could receive airdrops of these incubated projects

Metrics strong and growing rapidly: ALEX already had growing metrics prior to Nakamoto. We expect faster block times to result in exponential KPI growth - TVL and volumes

Potential CEX Listings: The Nakamoto Upgrade increases the likelihood of CEX listings which unlocks ownership by significant tokenholder bases

Stacks Investment Thesis

Thesis #1 | The Nakamoto Upgrade: Faster + Lower emissions

The Nakamoto Upgrade: A 100x+ improvement. The upgrade is a hard fork that decouples Stacks block production from Bitcoin’s block times, enabling faster transaction confirmations and introducing a new mechanism where Stacks’ miners produce blocks independently. Block confirmation times are expected to fall from >10 mins to ~10 seconds, a more than 100x improvement. The upgrade is already underway (launched at Bitcoin block 840,360 or on 22 Apr’24) and is expected to fully complete in Jul’24 (2 months delay from initially the forecasted May’24).

Nakamoto Upgrade enables DeFi. Even prior to the upgrade, Stacks had already seen activity pick up from a new crop of Stacks DeFi protocols - Zest, StackingDAO, and LISA to name a few. Post-upgrade, blocktimes will be dramatically reduced and we expect an improved UI / UX to drive further network activity. This should lay the groundwork for new applications that couldn’t previously exist. These primarily includes DeFi primitives that rely on liquidations and arbitrage to function. TVL is now $154m on the platform, of which < $100m is DEX TVL (~$60m TVL in ALEX staking). We think it is not inconceivable for DEX TVL to 5x to $500m with blocktime upgrades post Nakamoto, placing ALEX amongst other top ecosystem-native DEXs such as Aerodrome and Raydium with $750m and $700m TVL respectively.

STX halving. In conjunction with the upgrade, emissions will be reduced by half from 1,000 STX every Bitcoin block to 500 STX per BTC block. Given every BTC block takes ~10 mins, we expect this to reduce STX emissions / sell pressure by 76k STX a day or >$200k daily ($73m per year). We think this is relatively undertelegraphed as the tech upgrades (sBTC and Nakamoto) have been more in focus.

Thesis #2 | sBTC: A $10b TVL Opportunity

sBTC: First trustless solution for wrapped BTC. sBTC is the first trustless solution for bridging BTC from the main Bitcoin layer to another chain. sBTC is currently being developed by the Stacks core team alongside the Nakamoto upgrade, and will launch in Aug’24, 1 month after the upgrade completes.

The most decentralized BTC wrapper. sBTC relies only on a decentralized network of validators (fully permissionless to join). It is designed with a set of economic rules which incentivises validators to hold the peg in order to avoid collateral slashing. This contrasts with existing solutions such as Ethereum’s wBTC, R-BTC on Rootstock and L-BTC on Liquid, which are operated by centralized custodian or a group of trusted entities (multisigs) and embeds trust assumptions.

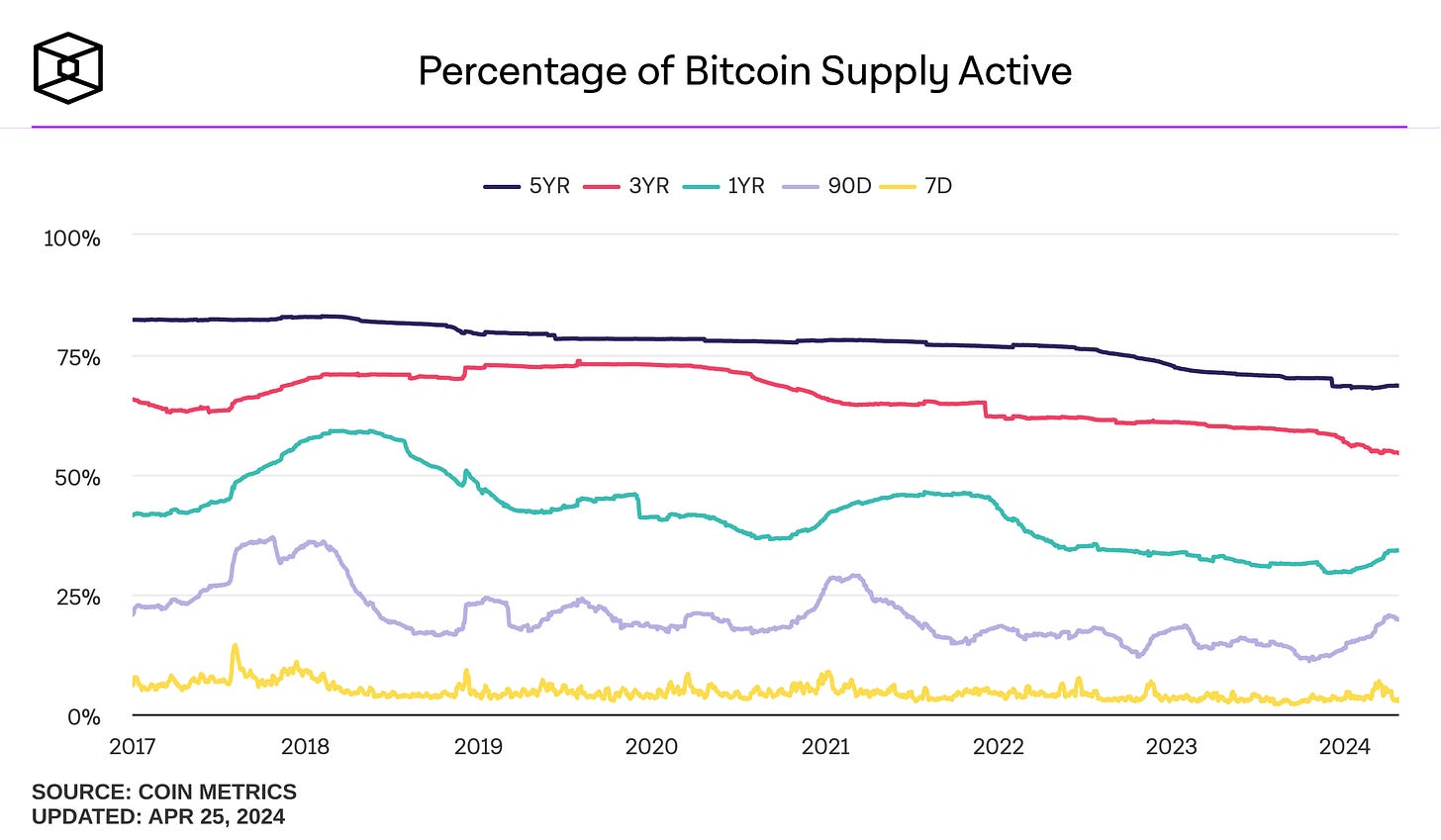

Trustlessness matters. We've spoken to Bitcoin whales and have learnt that they want to earn yield on their Bitcoin but often find it hard to trust custodial Bitcoin wrappers. Common pushbacks from using wBTC include: i) centralized mint and burn entities, 2) custodial risks and 3) KYC requirements. We believe this is what is driving only 55-60% of Bitcoin supply being active over the past 3 years. This is low considering BTC fluctuated between $15-75k in that period but this is changing.

sBTC to eat wBTC's lunch. We believe that sBTC being permissionless with open participation has the potential to unlock the liquidity of Bitcoin (especially whales) for use in DeFi. wBTC currently has around a $10b MCap, and we see sBTC potentially also achieving these levels with its more decentralized nature.

Thesis #3 | STX is the Best-in-Class BTC L2 Play

Addressing competition. We have seen several Bitcoin L2s recently emerge, and thought it would be prudent to address how Stacks is differentiated.

Top of the pack vs. older L2s. Older L2s such as the Lightning Network, Stacks, Rootstock and Liquid have been around since 2017. Stacks is ahead of the other older Bitcoin L2s for various reasons:

Versus Lightning Network & Liquid: Stacks has smart contracts. Both Lightning Network and Liquid Network do not support smart contract execution and are mainly used to facilitate Bitcoin transfers. As a result, we do not see these 2 networks as competitors.

Versus Rootstock: More adoption and more decentralized. Rootstock is the most similar to Stacks, as it supports smart contract execution via the Rootstock Virtual Machine (RVM), allowing users to migrate Ethereum contracts onto the Bitcoin network. That said, Stacks beats out Rootstock in nearly all relevant user metrics and is more decentralized. Rootstock’s BTC bridging solution, RBTC via Powpeg relies on custodians to maintain an equal 1:1 peg. While Stacks implements a similar architecture as of writing, with the sBTC upgrade, Stacks will move toward a permissionless bridging system which would be another incremental benefit over competitors such as Rootstock.

New entrants have smart contracts but are not yet Lindy. Recently, we have seen several Bitcoin L2s emerge, including Botanix, Merlin, Build-on-Bitcoin (BOB) and Chainway. While these solutions extend the BTC’s use case by introducing EVM-compatible execution layers, we believe Stacks is still in a prime position to pull ahead because of:

Higher degree of trustlessness: On sBTC launch, Stacks will still be the only L2 with a permissionless bridge (and one that Bitcoin whales will trust) therefore unlocking the most BTC liquidity

Competitor fragmentation: As the new crop of solutions implement their EVM-based solutions, these chains will be competing for liquidity between the various of other EVM chains out there. We expect Stacks to capture a much stickier user base of Bitcoin liquidity.

Competitors delaying launches: Most solutions such as Botanix have pushed back mainnet launch dates several times, and is now expected in Q3. BOB has set a mainnet date for late Q2. Until we see mainnet launches from competing solutions, our view is that most other solutions have a non-differentiated product in a heavily competitive EVM market.

Thesis #4 | Bitcoin Halving: Stacks as Beta

Bitcoin’s fourth halving. Bitcoin halvings have empirically been bullish events, with BTC rising strongly for 1-1.5 years in the past 3 halvings. On 19 Apr'24, Bitcoin had its fourth halving which saw block rewards fall from 6.25 BTC to 3.125 BTC and theoretically reduces emissions / sell pressure by ~$30m a day.

We see Stacks as a high beta to Bitcoin. Stacks tends to outperform Bitcoin on the upside as Bitcoin rises. If post-halving price action holds true for Bitcoin, we expect Stacks to outperform. Moreover, the network is at the cusp of its largest network upgrade ever, providing a technical / fundamental confluence.

Valuation | Base Case: 3x, Bull Case: 15x

For the above reasons (Nakamoto + sBTC + best-in-class BTC L2 + BTC post-halving beta), we think STX will emerge as a highly used Bitcoin L2 and expect STX to 3x from current prices to $16b FDV. This implies reasonable assumptions:

Stacks achieving 10% of wBTC’s TVL ($10b) on EVMs, giving it ~$1b in TVL

Arbitrum, Optimism, Solana, Aptos and Avalanche on average trade at ~16x FDV / TVL, applying the same ratio to our STX forecast TVL of $1b implies a $16b FDV

A more bullish scenario would look like this:

Stacks grows TVL to in excess of 50% of wBTC’s TVL on EVMs

Using 16x FDV / TVL multiple and $5b of wBTC TVL implies a $80b FDV, a 15x from current prices

ALEX: The Ecosystem Play

Thesis #1 | Buy the chain, Buy the native dApp

Not just a DEX, but a full DeFi product suite. While initially starting off as a DEX, ALEX has higher ambitions and has been incubating several other projects which include: 1) XLINK, a Bitcoin L2 bridge, 2) Gaze: An index network on Bitcoin, and 3) Lisa: LSTs for Bitcoin L2s. We speculate the ALEX token could receive airdrops of these incubated projects.

The largest dApp is usually the first port of call after the chain token. We've seen several examples where when the chain token rises, the native DeFi apps on the chain would rise more. ALEX is the largest DeFi dapp on Stacks by TVL. This makes it an instant target for capital looking to invest in STX DeFi once Nakamoto attracts more TVL into Stacks. ALEX re-rated sharply late last year during STX’s BTC ETF run up as speculative capital chased higher STX beta. This has since reversed and we believe that positioning is light, setting ALEX up for a second leg of re-rating.

Main liquidity pool is STX / ALEX. The STX / ALEX pool is close to $40m and is ALEX's primary source of liquidity, suggesting the price action of ALEX will be highly correlated with STX (albeit at a higher beta).

ALEX positioning is light. Our onchain analysis also suggests that most of the sellers of ALEX post its Nov / Dec'23 move are almost done selling. This has resulted in ALEX / STX to trade in a range since Mar'24.

Thesis #2 | Metrics: Up and to the right

Growth even prior to Nakamoto. ALEX’s bridging solution, XLINK has already been growing, facilitating some $115m of bridging volumes. While this still pales in comparison vs. Ethereum bridging volumes ($11b in the last month, based on DefiLlama data), we think this is just the beginning of demand growth for Bitcoin DeFi which is symbiotic with sBTC’s growth.

Growth after Nakamoto. We have spoken at length about how UI / UX will be improved on STX. With block times dramatically reduced, we see ALEX's metrics growing exponentially as trade velocity increases multifold.

Thesis #3: Potential CEX Listing

CEX listings unlocks new demographics of ALEX holders. Stacks has been well-covered institutionally (see Appendix #2), but is subject to several hurdles from institutional ownership:

Operational hurdles: Large funds and institutions are required to execute transactions via MPC wallet solutions which tend not to support niche protocols and chains (like Stacks and ALEX)

Knowledge hurdles: Traders tend not to be comfortable moving capital to a new chain and using new DeFi dapps

Capital efficiency: Traders are more willing to trade tokens with perps which allow for significant capital efficiency gains

Good candidate for listing post-Nakamoto. At $330m MCap, ALEX would typically be considered a good candidate for CEX listings if not for the uncertain and long block times on Stacks. Market makers will have to contend with price risk, and trading volumes would likely be low, resulting in low fees for CEXs. That said, the Nakomoto Upgrade's block time improvements will remove these friction points, making CEX listings more likely.

Conclusion

Turning point for Bitcoin DeFi. The Nakamoto Upgrade marks a critical turning point for Stacks, reducing block confirmation times and halving STX emissions, which directly addresses scalability and inflation concerns. The introduction of sBTC is set to transform Bitcoin’s role in DeFi by offering a decentralized, trustless bridge that could shift liquidity preferences away from centralized Bitcoin wrappers like wBTC. Given these enhancements and the context of Bitcoin's recent halving - which historically precedes significant market appreciation - Stacks is strategically positioned to capture increased market share and user adoption.

We are bullish on STX and ALEX, as both are set to gain from these network enhancements. ALEX, already the largest dApp on Stacks by TVL, is likely to see a surge in trading activity and liquidity, driven by faster and more efficient block confirmations. This positions ALEX well for an upcoming leg of exponential growth and re-rating.

Appendix #1 | Disappointing Runes launch = Need for Stacks

Runes launch resulted in STX underperformance. Runes launched on the day after the Bitcoin Halving amidst a backdrop of hype and pre-trading liquidity, both via BRC-20s and bridged versions (such as $PUPS on Solana). STX underperformed into the Runes launch as Bitcoin-related attention shifted away from quality Bitcoin L2 names like Stacks into the more speculative-natured assets in preparation for Runes.

Poor Runes UX resulted in flows to STX. As Runes failed to deliver on its promised seamless trading experience, the market saw the emphasized need for a dedicated execution layer on a Bitcoin L2. This rerated STX back upward as capital flowed back in. We believe these flows will only strengthen as we march toward the Nakamoto upgrade when Stacks showcases improved execution layer experience.

Expect As more institutions allocate to Bitcoin, mindshare for bitcoin-related ecosystem and execution layers will increase; and our thesis is that execution layer solutions such as Runes will fade, while STX captures the full growth of Bitcoin-secured DeFi. With other L2s mostly launching in Q3/Q4, Stacks is well positioned to capture the first mover advantage and has proven the Lindy-ness of its tech.

Appendix #2 | Stacks: Institutional Awareness

Stacks has been mentioned in two institutional reports so far, first by VanEck and later by Franklin Templeton.

VanEck (link): Predicted in Dec 2023 that the use of Bitcoin L2s will see a meteoric rise in 2024 as Bitcoin L2s continue to drive growth in Bitcoin network fees. They expect the 50-1 ratio in ETH to Bitcoin NFT issuances to fall by a factor of nearly 17x to a 3:1 ratio, while Stack’s breaks into the top 30 coins by market cap (already broken into the top #30, was #54 at time of writing)

Franklin Templeton (link): Stack’s Nakamoto Upgrade was covered by their Digital Assets arm and the increase in Stack’s TVL in the runup into Nakamoto was highlighted.

We are firm believers of Bitcoin DeFi benefiting heavily from institutional capital and flows. As institutional entities turn on their marketing machines, we anticipate an increase in attention toward STX from a new demographic audience - capital allocators hearing about STX for the first time from VanEck and Franklin Templeton.

Disclosure: The opinions expressed in this research piece are solely those of the author(s) and do not constitute financial advice. Ouroboros Capital may hold position(s) in the token(s) mentioned in this research articles. These position(s) may influence the author's perspective and analysis of the token. Readers are encouraged to conduct their own research before making any investment decisions.