Arbitrum Ants are back for the 50m ARB. Top plays: plsARB, GND, JONES, GRAIL.

We look at the top beneficiaries of Arbitrum's 50m ARB incentive program.

Disclaimer: This report was first published exclusively for Ouroboros Lifetime Access Pass holders on 24 Sep ‘23 here.

Conclusion Upfront: OP → ARB + Best Plays

Jul to Sep’23: TVL flowed from Arbitrum → Optimism. In the prior three months, we have seen significant TVL outflow from Arbitrum, falling from $2.5b to ~$1.7b today. One of the largest beneficiaries is the Optimism ecosystem (Base included), where we seen some $200+m inflow. The price action of ARB/OP has reflected this with ARB underperforming close to 30%.

Oct’23 to Jan’24: We expect TVL to flow back to Arbitrum. We think the recently passed 50m ARB incentive program will reverse four months of TVL flow as newly incentivized projects utilize their warchests to attract users. However, the Short Term Incentive Program (STIP) will not benefit all projects equally, we expect to see plsARB, GND, JONES, GRAIL outperform.

The 50m ARB Grant

Arbitrum Season v2 fuelled by Short Term Incentive Program (STIP). We think mindshare will start flowing back to Arbitrum with the latest incentive program now approved and expect the large amount of incentives (worth $40+m) to attract farming capital and kickstart activity across the ecosystem.

The TL;DR of STIP:

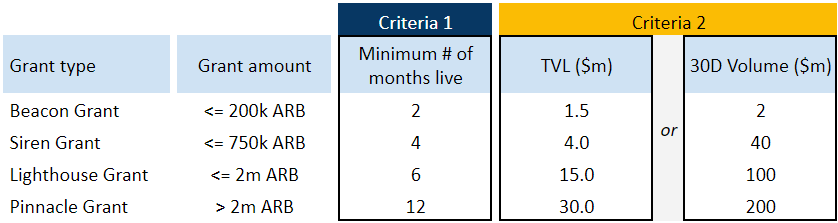

Incentives quantum: 50m ARB ($42m) earmarked for incentive grants

4 tiers of incentives: Beacon (<= 200k ARB), Siren (<= 750k ARB), Lighthouse (<= 2m ARB), Pinnacle (>= 2m ARB)

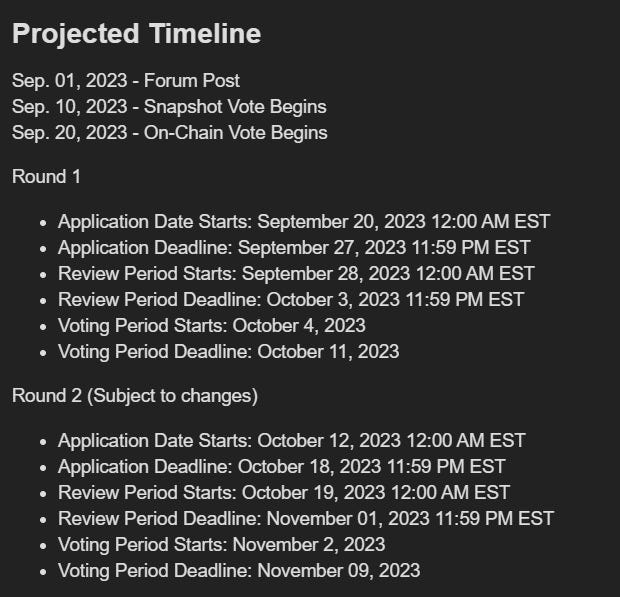

Timing: Granted funds to be distributed until the 31 Jan’24

# of rounds: 2 voting rounds

Application period. The timeline for this round of incentives is very accelerated with the application period starting on 20 Sep’23. During this period, we will see projects applying on the grant on the forums. We’ll be providing coverage on what they do on our channel.

Top Beneficiaries

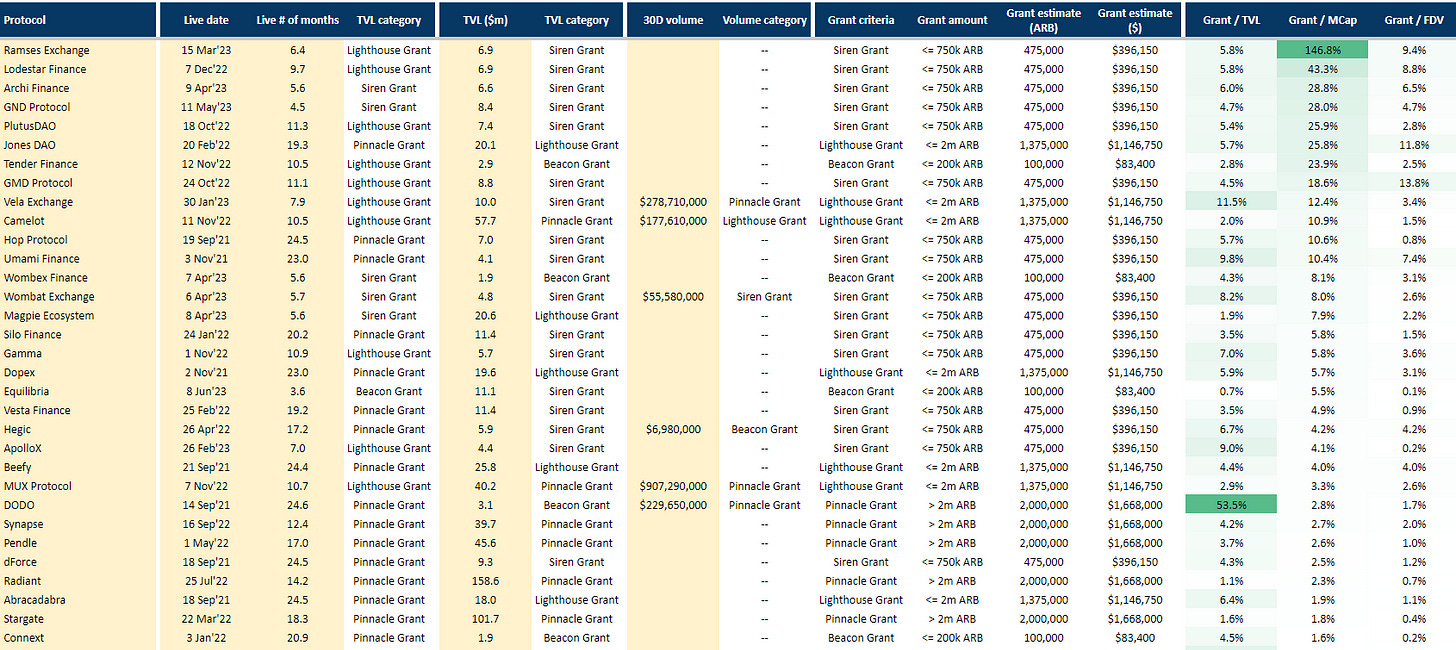

Our theory on who the winners will be. We do think that recipients that receive a large grant relative to their TVL / MCap / FDV will see a outsized impact on their TVL, volumes and token prices. The criteria for grant eligibility is contingent on 1) # of months live on Arbitrum and 2) TVL or 30D volume.

Analysis: Estimating grant sizes before applications hit the forums

Using existing metrics to estimate the grant size each project is eligible should help to front-run project applications (which we think drives prices).

We took a list of Arbitrum projects above $1.5m TVL and listed down:

# of months they have went live on Arbitrum

Current TVL

Aug’23 volumes (if applicable)

Project Grant Tiers: We then looked at what tier of grant each project should be able to get based on the eligibility critieria and compared the grant received to their MCap / FDV / TVL. For simplicity, we take the midpoint of the ARB grant ranges within each tier (eg. Siren = (750k+200k) / 2 = 475k ARB).

How grants help: We expect the prices of those receiving outsized grants to outperform its peers as grants get deployed → TVL / volume increases → fundamentals improve → token goes up. This is similar to when Arbitrum DAO airdropped projects tokens. Here are the results.

The top projects that we think will be the largest beneficiaries are plsARB, GND, JONES, and GRAIL.

Project 1: PlutusDAO (26% Grant / MCap)

Stats: Live for 11 months, $7.4m TVL, likely Siren Grant (<=750k ARB), has a lot of ARB voting power.

PlutusDAO has had its fair share of controversies - it initially launched plsARB as a liquid staking wrapper for ARB even as there is no locking mechanism for the L1 token. Despite this, ARB airdrop recipients have locked up close to 10m ARB.

Given a lack of avenues to use the wrapper, lockers have been slowly selling their plsARB, now at a 70% discount. The team then used its own ARB DAO airdrop to buy 300k ARB worth of plsARB from the LP and also airdropped 300k ARB to plsARB holders.

The play: plsARB > PLS. While PLS seems like the obvious and could receive around 26% grant / MCap. We think plsARB is more exciting. its current 60% discount to ARB is below the price of the recent buybacks and airdrops.

We believe that with the grant, PlutusDAO can obtain up to 750k ARB ($600K USD) which the DAO can use to incentivise TVL flow into PLS or even the repegging of plsARB. The PLS team has indicated that they are willing to play the long-game in bringing value to plsARB either through governance or earning yield from staking/LP-ing and it is not in the interest of the team to see plsARB fail.

All these lead us to think that plsARB could be a direct beneficiary of the STIP (better than PLS).

Project 2: GND Protocol (29% Grant / MCap)

Stats: Live for 5 months, $8.4m TVL, likely Siren Grant (<=750k ARB).

GND protocol is a Univ3 liquidity engine and farm, the protocol earns revenue collected from its univ3 engine and gmUSD (yield-bearing stablecoin). GND currently has $8.6m in TVL with a MCap of only $1.3m, its MCap/TVL ratio also looks cheap at 6.6x.

The GND ecosystem had previously underperformed due to an OTC scam and lack of communications by the team. However, the team has also said that they will be publishing their grant proposal draft in the next 48 hours. If passed, they will be eligible for up to 750k ARB if their grant proposal is passed.

Other potentially catalysts include a tokenomics revamp, moving from inflationary tokenomics and instead cutting all emissions + turning GND into a sustainable Univ3 liquidity hub.

Project 3: JonesDAO (26% Grant / MCap)

Stats: Live for 19 months, $20.1m TVL, likely Lighthouse Grant (<=2m ARB).

JonesDAO currently has 3 vaults for users to deposit their Aura, GLP or USDC to earn amplified yield. Its TVL of $20m and good Arbitrum history avails the project to a Lighthouse Grant (<=2m ARB), which is significant relative to its MCap. There are many strategies the project could put to use with the ARB both for JONES holders and vault depositors.

Other potential catalysts include the project’s buyback announcement of the JONES using performance and withdrawal incentives of around ~$430k.

Project 4: Camelot (11% Grant / MCap)

Stats: Live for 11 months, $58m TVL, $178m Aug’23 volume, likely Lighthouse Grant (<=2m ARB).

Camelot recently applied for a 1.5m * 6 months grant = 9m ARB. This was met with pushback and was subsequently defeated in a snapshot vote.

Camelot will likely be eligible for the Lighthouse Grant (<= 2m ARB) given its limiting 11 months lifespan on Arbitrum. By applying during the second window, the project might possibly be eligible for the Pinnacle Grant (>= 2m ARB) as it graduates past the 12 month mark.

The ARB allocation could be used to incentivize LPs or provide additional value to xGRAIL converters. While there has also not been a proposal out yet, we are following the Arbitrum forum closely. The team has mentioned on Discord they are currently working on the proposal and discussing how much ARB tokens to apply for.

Current Proposals

Arrakis Finance (Proposal here)

Arrakis Finance is the largest LP manager on top of Uniswap V3. The project requested for 846k ARB tokens and 96% (803.7k ARB) will be used for liquidity mining while 5% (42.3k) will be taken as a payment to Arrakis Finance.

The ARB rewards will be used to incentivise their 7 LST vaults. As of Sept 22, Arraki’s TVL on Arbitrum is only 833k, there are certain discussions going on if Arrakis will even be eligible for such a large grant.

Frax Finance (Proposal here)

FRAX has drafted a proposal for a 1.5m ARB grant. This grant will be used to incentivize users of both Frax stablecoins and staked ETH tokens. The project plans to disburse 900k ARB immediately and the remaining 600k to be disbursed when certain milestones are achieved (e.g. 10m FRAX bridge to Arbitrum in 30 days).

GFXLabs fully supports this proposal however some have raised the concerns that FRAX’s liquidity on Arbitrum is quite thin and Frax’s TVL on Arbitrum is only $2.3m.

A successful proposal reinforces our bullish thesis on Frax Finance (see our report here).

Wormhole (Proposal here)

Wormhole is a cross-chain messaging protocol and they are applying for the maximum grant of 2.5m ARB. Wormhole’s objective is to onboard 100m USDC into the Arbitrum ecosystem.

To incentivise this, users who mint USDC with the CCTP and hold their USDC will be eligible for 8% rate of return, with reward accruing every 7 days. This reward period will span 12 weeks.

We think Wormhole is likely eyeing Stargate’s larger presence of Arbitrum and think that this is a novel way to gain market share while opening up a new venue for farmers.

Dopex (Proposal here)

Dopex has applied for a 1.5m ARB grant to use it to increase protocol sequencer fees paid to Arbitrum and jumpstart the Dopex V2 ecosystem: RDPX V2, CLAMM and Options AMM.

If this proposal were to pass, Dopex would be receiving north of 6% of its MCap in grants. The grant will likely be channeled into their new products and bode well for DPX and rDPX. That said, we think spending 20% of the grant on audit expenses is high.

Tracking Forums

We’ll be following the grant application activity closely on our channel. The initiative will be led by @OxTechnion and @quirkyllama on Telegram.

Why is the DeFI protocol, which simply receives more $ARB(such as DODO,MUX Protocol), not mentioned as the biggest beneficiary?