Maker Update #2: DSR is working

DSR's multi-trillion dollar TAM.

Disclaimer: This report was first published exclusively for Ouroboros Lifetime Access Pass holders on 28 Sep ‘23 here.

MKR Outperformance: MKR is currently testing new highs. Its up 32% in 42 days since our update report on 17 Aug that called for a dip buying opportunity. By contrast, BTC is down -1% and ETH -5% in the same period. Since our first report on 17 Jul, MKR is up 61% vs BTC -12% and ETH -15% over the same period.

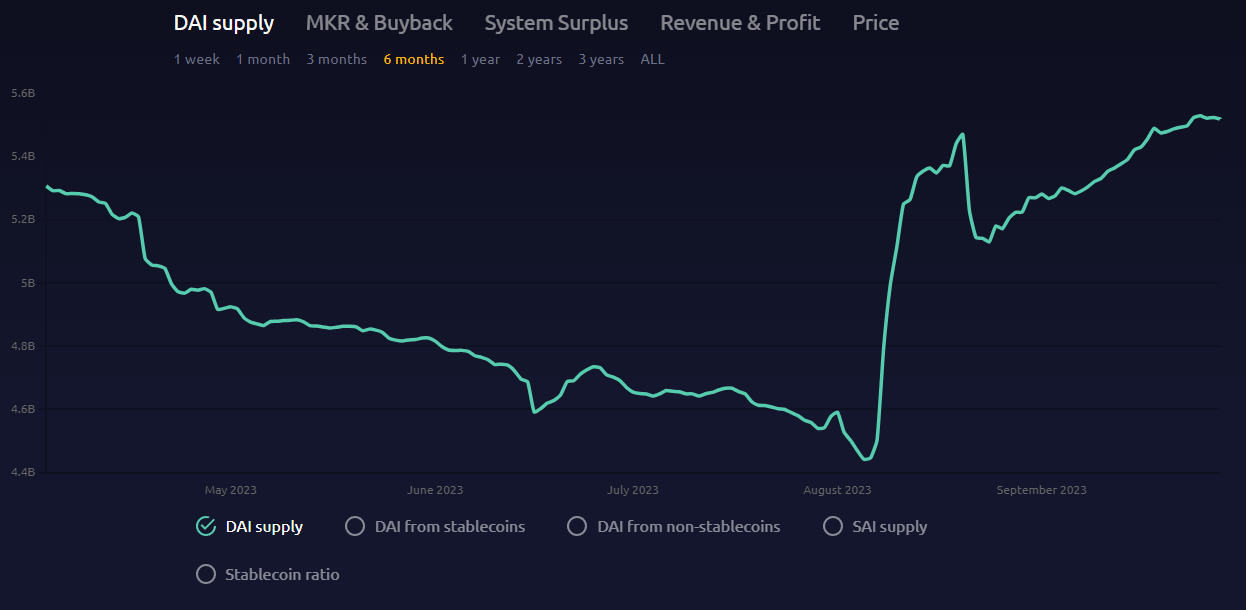

In our recent update report, we underscored our anticipation of dip buyers stepping in given MKR’s strong value accrual in environment where front-end rates are expected to stay high. We called for a new high in DAI supply as well as profits. DAI supply has indeed reached a new peak while profits are recovering well and on track to approach highs. We have also called for the token to test the $1,500 - $1,600 level, a view that is currently materializing. While we will be taking some profits at the current level, our long term bullish view remains. We have trimmed the position from one that was severely outsized to a more balanced core holding (>20%). Our strategy going forward will be to trade around the position, accumulating during dips, with the view that it goes 20-30% higher in the next 6 months.

In this second update, we will take stock of recent developments to highlight insights that drive our longer term bullish outlook in MKR.

Insight #1: DSR is working.

Over the past month, as per our thesis, DAI in Savings Dai (sDAI) alongside DAI supply has been hitting new highs. This indicates that the Dai Savings Rate (DSR) is effectively fulfilling its dual objectives: firstly, raising awareness of sDAI as the preferred on-chain venue to access US Treasury yields, and secondly, stimulating the generation of new DAI. Collectively, these factors paves the way for higher MKR profit in the long run.

While we highlight that higher DAI supply through sDAI deposits does usher higher profits in the long run, we also recognize a common pushback: the present surge in DAI creation and its deposit into sDAI does not boost MKR profits but instead drag it. This is indeed true and valid given that sDAI is disbursing 5% while the highest yield MKR can garner (via BlockTower Andromeda) is capped at 4.5%. Yet, we align with Maker Founder Rune's perspective that this is a transient pain for a more promising long-term plan. Our analysis suggest that it won't be long until the DSR transitions to Tier 3, where the rate would be calibrated at 4.1%. This shift would subsequently render new creation and deposits of DAI into the DSR profit accretive for MKR as the protocol pays 4.1% on DSR and makes 4.5% via vaults like BlockTower Andromeda.

We extrapolate DSR’s recently utilization growth and conclude that utilization could touch the 50% mark within 6 months. In the past month, the 7D rolling average of daily DSR utilization growth has varied between 0.11% to 0.42%, with an average of 0.21%. Should the DSR utilization consistently grow by 0.11% per day (which represents the lower threshold observed in the past month), it would take only 45 days before it hits 35%, triggering a reduction in DSR. Furthermore, at the 0.11% daily growth rate, in roughly six months (181 days) the utilization would touch the 50% mark, triggering in a further shift to the Tier 3. See here for spreadsheet. The decrease in the Dai Savings Rate, in tandem with the growth of DAI adoption, will be evidence that DSR is both profitable and sustainable. We believe this is the next major catalyst for MKR.

Insight #2: DAI supply growth means MKR can compound profits at 20% p.a.

We observe that DAI supply has been growing at $250-$290mn per month over the past 3 months. If we were to extrapolate this number, it would imply a supply growth of at least $3bn per year. Assuming all $3bn of DAI growth is deposited into sDAI at the 4.1% rate (Tier 3) and yield is generated at 4.5% (BlockTower Andromeda), it would imply a incremental profit of $11.95mn per year (or 20% growth on current est. profits). While 20% is indeed a decent figure, we think that this is still rather conservative, which leads us to our next section.

Insight #3: sDAI has a multi-trillion dollar TAM.

We believe the adoption of sDAI has yet to see a hockey stick moment and believe that DAI’s current market cap of $5.5bn is still miniscule compared to the global demand for on-chain US Treasury yields. For context, according to the 2023 UBS Global Wealth report, non-millionaires global wealth share is ~55.5% (~$115tn). While US Treasury yields are easily accessible to the privileged via traditional banking channels, they often out of reach for the common man in non-US countries. Readily available on-chain access to US Treasury yields to the 55.5% of global wealth that aren’t millionaire is a much desired product that has a massive TAM ($115.44tn according to the above statistic).

Conclusion

There's a clear trajectory for DAI's growth as it taps into the multi-trillion-dollar TAM seeking easily accessible US treasury yield. Yet, we anticipate a 3-6 month catalyst void before DSR kicks into full gear (when DSR drops to 4.1% upon reaching Tier 3). Consequently, we've trimmed our position. That said, it still remains a a core position for us as we don't discount the possibility of a further re-rating, especially since this token is one of the best assets to hold in a high-rate environment.

Feel free to reach us at our public TG - https://t.me/OuroborosNarratives.