Ouroboros Governance Review #4: Arbitrum STIP Round 2 Working Group, dYdX locked staking and fee restructuring

We first released this article on 20 Nov'23 to Ouroboros Lifetime Access Pass holders who get early access to our writing.

Welcome to Ouroboros Governance Review where we share interesting governance actions and their respective implications. This week, we will be covering:

Arbitrum Round 2 STIP

dYdX staking and fee restructuring

None of the following is financial advice

Governance Action #1: Arbitrum Short Term Incentive Program (STIP) Round 2 Working Group

Governance proposal: Following the successful backfunding temp check proposal to award 21.4m ARB to an additional 26 projects building on Arbitrum, the Sushi team has put up a discussion post to create a new working group for a potential STIP Round 2. This group will focus on improving on the results of STIP round 1, incorporating the data from round 1 while optimising allocation guidelines and reducing the workload for delegates. The group aims to include representatives from Arbitrum Foundation, round 1 members, stakeholders from several verticals as well as community advocates.

Implications: With a more proper framework in place, we believe this greatly increases the chances of Round 2 occurring given the positive momentum it has garnered. In STIP Round 1, grantees with outsized grant to MCap ratios had outperformed. We think round 2 will be no different.

Current prominent applicants include Y2K Finance (500k ARB to incentivise Earthquake) and Ondo Finance (1.5m ARB to incentivise DEX LPs). Plutus had previously said it intended to apply for round 2 and failed applicants from round 1 can likely also apply. We recommend closely watching the list of applicants in the Arbitrum forums (the following table shows the current applicants).

Likelihood of passing: High. The backfunding proposal temp check passing suggests there is appetite to give out more grants and we expect a STIP round 2 to pass.

Governance Debate #2: dYdX locked staking

dYdX locked staking: dYdX v4 includes changes to the protocol's fee structure and staking incentives - transaction and trading fees will now be fully distributed to validators and stakers instead of being collected by the protocol. On 1 Dec'23, approximately 150m dYdX tokens will be unlocked. 83m (55%) of this will belong to investors, 66m (45%) will go to employees.

Over the last week, there has been heated debate about investors being able to stake their locked tokens in order to earn rewards (special thanks to Evanss6 who brought this up). This information has always been available in dYdX docs.

Implications: Enabling locked staking essentially increases the stakeable supply and dilutes fees. Without investor staking, the stakeable supply would have been 341m dYdX. If we include the locked investors component, the stakeable supply would increase to 536m dYdX (or 57% higher than the previously calculated stakeable supply) which places effective dilution of fees at ~36%.

In the past 4 weeks revenue has averaged $1.8m-$2.5m weekly. Assuming a $2m weekly run rate, fees will be ~$100m annualized which now implies a 18% APY at 30% staked, 11% APY at 50% staked and 8% APY at 70% staked. For more detailed analysis, see our previous dYdX report here.

While still attractive, we think this reduces the attractiveness to buy and stake dYdX. We will be watching for more clarity on staking (potentially different pools for staking mentioned in discord).

Governance Action #3: dYdX v4 trading fee restructuring

Governance proposal: In a discussion post, CipherLabs, an Endorsed Delegate for dYdX has proposed a new fee restructuring for dYdX v4 in order to encourage high volume and user base growth.

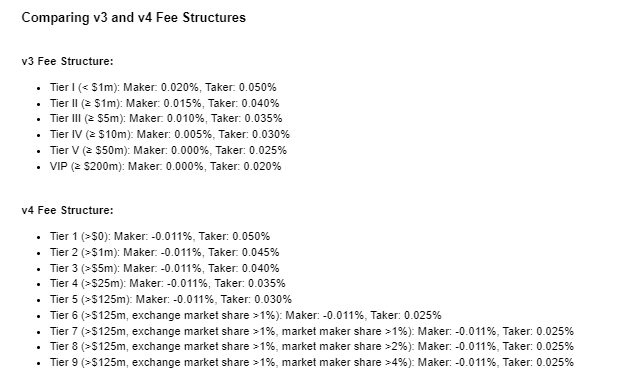

The current v4 fee structure has a higher taker fee compared to v3.

For tiers 2-5, taker fees are 0.005% higher.

The trading volume required to advance into higher fee tiers has is also higher

CipherLabs thinks this larger gap between tiers may deter traders from using the platform.

The proposal highlights a new revised v4 fee system similar to v3, with the intention of making it more sustainable as well as encouraging higher trading volume. The proposal broadly 1) reduces the thresholds, 2) increases maker fees at lower volumes and 3) reduces taker fees.

CipherLabs also published a supplementary comment about how the dYdX can be implement token utility which allows dYdX holders to be charged lower fees (similar to BNB).

Implications: Reverting the fee structure to make it similar to v3, will enable dYdX to maintain the current fee levels. Regardless, dYdX is still extremely competitive across volume tiers (still beats Binance). This should result in volumes maintaining despite v3 transaction and LP rewards stopping in early 2024.

Likelihood of passing: High. Given staking is now switched on, we think governance would prefer current levels of fees to be maintained instead of adopting a more aggressive approach at attaining users.

Other Governance Actions

Capital Deployment

1inch proposal to swap 2.5m ARB tokens in the DAO treasury for USDC.

Apecoin discussion to slash the Apecoin only staking pool by 10m ApeCoin.

dYdX proposal for a $1m community grant program to incentivise new projects and domain allocators. They will adopt a Delegated Domain Allocation model that empowers allocators the ability to have decision making powers.

GMX's new grant program where projects can submit a grant for funding has seen 8 applications so far( Mozaic AI, Rabbithole, GMX analytics, GMX developer academy, Safe Yield DAO, Penpie, GMD, Perpetual positions).

Redacted proposal to request $1.2m for protocol expenses for 1 Dec 2023-31 May 2024. This will be used to fund operations as well as expand new products (Dinero, pxETH and Marionette).

Yearn proposal to create an ATOM vault. This can help boost Yearn TVL significantly and unlock yield farming opportunities for ATOM.

Protocol changes/tokenomic changes

Aave proposal to onboard wstETH, sfrxETH, nativeUSDC onto AAVE v3

Astroport proposal to revise the tokenomics of ASTRO by introducing a vxASTRO model where ASTRO holders can lock up their staked xASTRO for boosted LP rewards and governance power over emissions. Astro emissions are currently around 50m ASTRO a year

Atom proposal to reduce the inflation rate of Atom from 14% to 10% and staking APR to drop from 19% to 13.4%. It is currently 39% against it with 36% supporting the proposal. Atom inflation at 10% is still rather high

Optimism proposal to conduct a Canyon Network upgrade. This upgrade helps to reduce base fee volatility as well as enhanced developer experience.

Prisma Finance proposal to deploy Hidden Hand market to unlock voting power.

Other

Arbitrum proposal to have a new native experimental incentive system for active DAO delegates. It seeks to implement a tier system based on a scoring framework.

Ethereum Discussion on combining EIP-2938 and ERC-4337 to implement Native Account Abstraction. RIP7560 introduces consensus-layer protocol changes where EOAs can submit a new transaction type(AA txn) in the same way a normal transaction would go through. The goal here is to see increased adoption and usage of account abstraction.

Previous Ouroboros Governance Reviews

Issue #3: Backfunding of Arbitrum's Short-Term Incentive Program, Sushi tokenomics revamp, Rocketpool tokenomics overhaul (Link)

Issue #2: ARB Staking, LayerZero / Lido wstETH OFT, Uniswap's Ekubo investment (Link)

Issue #1: Blur fee switch, ApeCoin ZK L2 powered by Polygon CDK, Sunsetting Lido on Polygon (Link)